India's $6.4-bn back tax claim fails to dent foreign inflows

Foreigners were net buyers of local equities every day barring one since the finance ministry said April 6 it is well within its rights to send notices

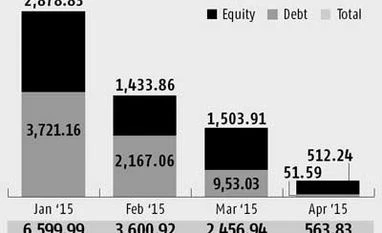

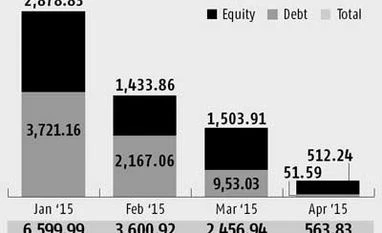

Bloomberg New Delhi/ Mumbai As foreign portfolio investors balk at India's claim of $6.4 billion in back taxes, the finance ministry's latest demand isn't damping interest in the nation's stocks and bonds.

Foreigners were net buyers of local equities every day barring one since the finance ministry said April 6 it is well within its rights to send notices. Finance Minister Arun Jaitley reiterated the claim this week in an interview to the NDTV 24x7 television channel, saying funds still need to pay 20 per cent on capital gains for the years through March 31.

"There won't be a major impact on flows because India is such a destination that you have to be there because of the potential returns," said U R Bhat, a director at the Indian unit of UK-based Dalton Strategic Partnership LLP, which oversees $2 billion in assets.

Prime Minister Narendra Modi, who promised a stable tax regime to boost investment and growth in Asia's third-biggest economy, is grappling with some of the legacy legislation left by the previous administration that spooked investors and weakened the rupee to a record in 2013. Inflows this year reached $6.34 billion, the most in Asia after Japan, while the benchmark index is near an all-time high.

Jaitley told the television channel that the tax dues were legitimate as investors who had petitioned the courts had lost their appeal. The levy was scrapped under new tax laws starting April 1.

Change face "The amount involved is Rs 40,000 crore," Jaitley told NDTV 24x7 channel. "I can change the face of India's irrigation with that."

About 100 foreign portfolio investors have been served notices to pay tax dues worth $6 billion, the Times of India newspaper reported April 6, without saying where it got the information. More notices are being sent out and the total dues could be over $10 billion, it said.

Separately, several overseas firms including Cairn Energy Plc and Vodafone Group Plc are locked into disputes with various tax authorities. Cairn India has been asked to pay over $3 billion in taxes and interest after Cairn UK carried out restructuring in preparation for the Indian unit's public offer of shares while Vodafone is also seeking to resolve a tax dispute exceeding $2 billion over its 2007 acquisition of Hutchison Whampoa's Indian business.

No haven

India isn't a tax haven and authorities will pursue legitimate dues from foreign investors, Jaitley told an industry conference on April 6. In his February 28 budget speech, the finance minister clarified that foreign funds will not be covered under Minimum Alternate Tax from April 1.

"The finance minister has taken a decision that this tax is not right from this year," Dalton's Bhat said. "He should have the conviction of saying this was not right in the previous years."

Modi also needs the money as he boosts spending on highways, ports and power to spur growth and cement India's position as a leading growth driver among emerging markets as China's economy slows. Projections by the International Monetary Fund this week showed India will power past China for the first time since 1999 this year.

)

)