Institutional investors hit as Infosys shares fall over CEO's resignation

415 MF schemes have exposure to Infosys shares worth a total of Rs 21,240 cr

)

Explore Business Standard

415 MF schemes have exposure to Infosys shares worth a total of Rs 21,240 cr

)

Following Vishal Sikka's resignation as CEO of Infosys after a prolonged tussle with the founder promoters, institutional investors are cautiously watching the unfolding drama at the Bengaluru-based information technology (IT) major. Infosys figures among the top holdings for many institutional investors and Friday's 10 per cent drop has made a huge dent in their portfolios. Given the high weightage of stock in benchmark indices, the stock is a must for many portfolios and exchange-traded funds (ETFs).

Some fund managers said the sharp correction in Infosys' shares provided a good buying opportunity to enter the counter ahead of an impending buyback announcement.

"We see value at current levels. We don't see much downside from here as there is a valuation support," said chief investment officer (CIO) of one of the largest fund houses, asking not to be named as they are not allowed to speak to specific stocks.

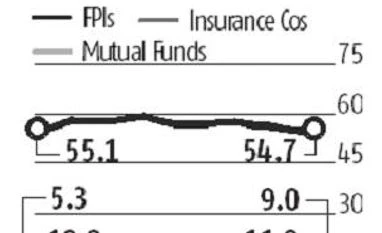

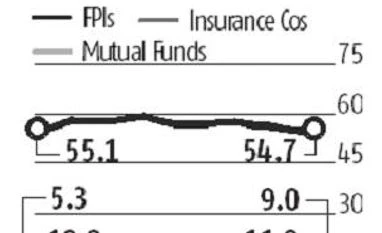

In the past one year, the shareholding of mutual funds has increased 240 basis points (bps) to nine per cent at the end of June quarter. Foreign portfolio investors (FPIs), on the other hand, have cut their exposure by 300 bps to 54.7 per cent.

"FPIs are more interested in the company's performance rather than the personalities running the company. At present, there is no information regarding specific wrongdoing within the company. To that extent, the investors are likely to put this episode behind them in due course provide the allegations and counter-allegations around corporate governance die down. Any fresh controversies, however, could lead to a more permanent damage to Infosys' image and credibility," said an overseas investor, on condition of anonymity.

Another CIO of a fund house says the stock may not drop below Rs 875 and can offer a good upside from a 2-3 years perspective.

"It's a board-driven company and has adequate checks and balances when it comes to corporate governance. Balance sheet is one of the strongest which gives me comfort. The problem is not with the company but the IT outlook in general. Of course, we can't take a strong bet on the company even at low levels as [the] upside is also limited. But this is the opportunity to average out and we won't mind adding some more of Infosys," he said.

There are 415 mutual fund schemes having exposure to shares of Infosys with a collective invested amount of Rs 21,240 crore, making it one of the top five most invested stocks by fund managers.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Aug 19 2017 | 2:30 AM IST