Iron ore prices at 5-year low on excess supply

BHP Billiton, Rio Tinto to keep supply surplus of 100 mn tonnes amid falling demand from steel mills

Dilip Kumar Jha Mumbai Iron ore prices have declined to a five-year low on falling demand from China and more of oversupply from the world’s two largest miners, BHP Billiton and Rio Tinto.

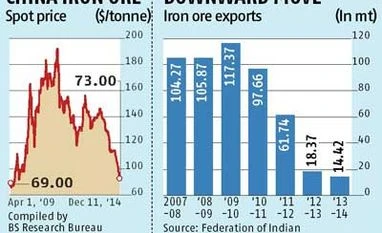

After a high of $163 a tonne in 2011, ore started falling as China, the world’s largest consumer, ordered closure of small and non-viable steel mills. Ore is currently traded at $73 a tonne in the spot Chinese market, a level not seen since September 2009.

The price declined has been 39 per cent so far this calendar year. Analysts forecast a further decline to $63-64 a tonne on excavation in new mines. The falling prices will directly benefit steel mills in India and abroad.

“The world market is expected to face an oversupply of around 70 million tonnes in calendar year (CY) 2014, as compared to almost negligible supply excess in 2013. BHP Billiton and Rio Tinto have intensified excavation on existing mines and new mines have added their output. New origins like Iran and South Africa have also started supplying ore to Chinese steel mills,” said Prakash Duvvuri, an analyst with Ore Team, a Delhi-based research house.

JPMorgan has forecast the price to extend its decline. The bank lowered its forecast from the earlier estimates by 24 per cent to average $67 a tonne this year and 23 per cent lower than earlier estimates at $65 a tonne in 2016.

HSBC Holdings, reports said, forecast global seaborne iron ore supply to exceed demand by 100 mt in CY 2014 as compared to a mere 16 mt in CY 2013. The bank forecast the average iron ore price at $99 a tonne this year and $85 a tonne in 2015.

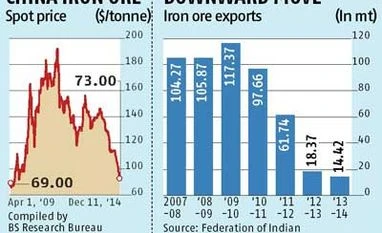

While mining activities have been very slow in India, a 30 per cent export duty has made shipment of ore unviable. Barring a small quantity exported from Odisha, there is no shipment at present from the country including from Goa, which until a few years earlier was producing 90 mt annually of low-grade ore for export to China.

“There has been no iron ore export from October onwards, as falling prices make Indian exports with 30 per cent duty unviable,” said R K Sharma, secretary general, Federation of Indian Mineral Industries.

Exports were 14.4 mt in 2013-14, a fall of 21.5 per cent from the 18.4 mt in 2012-13.

)

)