Justdial to ring in gains for retail investors

Street expects listing at a premium of over 10 per cent

Samie Modak Mumbai

Justdial, which will make its stock market debut tomorrow, is expected to ring in good gains for retail investors, who were offered shares at a 10 per cent discount to the issue price.

The company, a local search engine, is expected to list at a premium of more than 10 per cent, going by broker estimates and grey market rates. In the unofficial market, over Rs 600 a share was being offered to investors, who got allotment through the initial public offering (IPO), said at least three brokers based in Mumbai and Gujarat.

The company has fixed the issue price at Rs 530 a share, but retail investors were alloted shares at0477, after a 10 per cent discount. The IPO price band was between0470 and0543.

Arun Kejriwal, director, Kejriwal Research and Investment Services, who tracks the IPO market closely, expects shares of Justdial to list around0620 if the secondary market is stable.

“As only 10 per cent of issue was meant for retail, there won't be much selling pressure, which is typically seen on day one as small investors try to make an exit with listing gains,” he said.

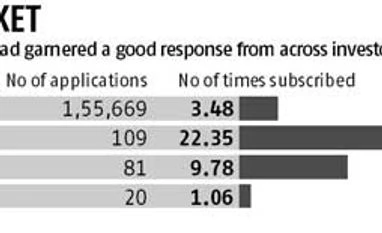

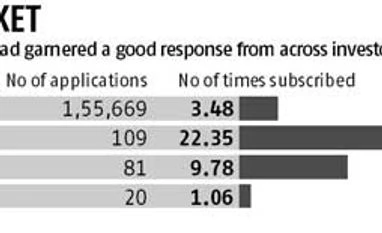

Justdial IPO had garnered good response from investors as it was subscribed nearly 12 times. The institutional investor and high net worth individual category was subscribed 10 times and 22 times, respectively, while the retail investor category was subscribed 3.5 times.

The IPO attracted nearly 156,000 retail applications. As per the basis of allotment, irrespective of the application amount, retail investors were alloted one lot of 25 shares each that too on a lottery basis with a allotment probability of 45 per cent. Only 10 per cent of the issue was reserved for retail investors as 75 cent of the issue had to be institutional investor-backed as the company didn't meet Sebi's profitability criteria.

Along with the discount, the company had also offered the safety net option for retail investors. Under the safety net arrangement, the promoters of Justdial will repay small investors if share price of the company falls below the issue price six months post listing.

The Justdial offering, which closed for subscription on May 22, had raised about0900 crore. The entire issue was offer for sale from existing shareholders, including promoter and founder V S S Mani and institutional investors like SAIF Partners, Tiger Global, Sequoia Capital and SAP Ventures.

The investment bankers to the issue were Citigroup Global Markets India and Morgan Stanley India.

)

)