L&T Infotech IPO subscribed 11 times

Company's 12.25-mn share offering attracted 132 mn bids

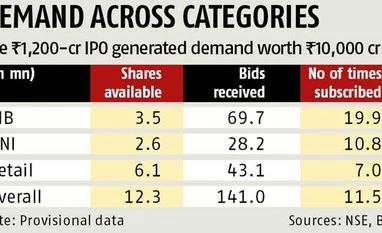

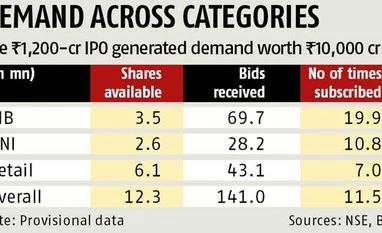

Purva Chitnis Mumbai L&T Infotech’s Rs 1,230-crore initial public offering (IPO) has garnered 11 times subscription, helping parent Larsen & Toubro (L&T) successfully divest a little over 10 per cent stake. The company’s 12.25-million share offering attracted 132 million bids, data provided by stock exchanges showed. The issue attracted nearly one million applications from retail investors, which is among the highest in recent IPOs.

The demand from institutional investors was robust, with the qualified institutional buyers category witnessing 20 times subscription. The retail segment was subscribed seven times and the high net worth individual category got subscribed nearly 11 times. In terms of oversubscription, however, demand was less compared to some of the recent IPOs such as Quess, which had seen 100 times more demand than shares on offer.

“L&T Infotech is one of the largest IT services that have come up in the past one decade. Besides, it also got benefited from the parent brand of L&T,” said V Jayshankar, senior executive director and head of equity capital markets at Kotak Investment Banking, one of the bankers to the IPO.

After the IPO, L&T’s stake in the company would drop from 94.94 per cent to 84.64 per cent. Shares of L&T ended 1.2 per cent lower on Wednesday. After listing, L&T Infotech might have a market capitalisation of around Rs 12,000 crore, pegging it in mid-sized IT firms.

“We believe L&T Infotech with its revenue size, high return ratios and redoubtable parentage should command about 10 per cent valuation discount to Mindtree on inferior growth, while the IPO price band indicates a much larger discount. Thus, we believe the promoters have left something on the table for the investors in terms of valuations, which we view as a major positive factor in favour of the IPO,” Reliance Securities had said in a note, advising investors to ‘subscribe’.

“Assuming the company maintains its historical average rate of dividend payouts, it would translate into a yield of four-five per cent for the investor. Apart from the favourable prospects of the company, we also foresee decent gains on listing,” Angel Broking had said in a note.

"The bankers and issuers have been very pragmatic in terms of pricing the IPOs. That has attracted investors (towards recent IPOs),” said Jayshankar.

)

)