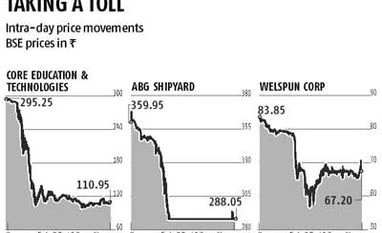

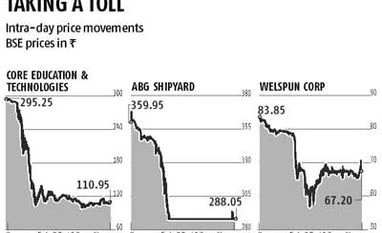

Margin calls drive down mid-cap shares

Reason not clear, with firms in question denying any sale of pledged holdings

BS Reporter Mumbai

Selling sparked by margin calls took a toll on stock markets on Monday. Shares of mid-cap and small-cap companies plunged on speculation that financiers sold a portion of pledged holdings after some promoters and traders could not cough up more money to make up for the shortfall in margins.

The Bombay Stock Exchange’s mid-cap index fell 1.2 per cent and the small-cap index 1.4 per cent against the Sensex’s marginally higher closing. Among stocks, CORE Education dived 62 per cent, and Welspun Corp, Aanjaneya Lifecare and ABG Shipyard tumbled 20 per cent each.

While promoters pledge their shares as collateral for loans, large traders take bets on stocks through margin financing, where the financier part-funds their stocks or derivative positions. When bets turn awry and they are unable to bring in additional collateral or margin money, financers sell these.

A top CORE official denied market talk that financiers had sold a portion of the company promoters’ pledged shares. The CORE promoters have pledged about half their holdings.

“None of the shares it has pledged with institutions has been sold and it has confirmed with all the institutions that they continue to hold the same,” said Nikhil Morsawala, director, finance, CORE.

He said the company was yet to ascertain the reason behind the fall in the stock. “We are trying to find out the reason. We have spoken to the exchanges. We cannot confirm the reason, unless we have market data for it,” he said.

ABG Shipyard’s chief financial officer and executive director, Dhananjay Datar, told a channel he was not aware of any selling in pledged shares. He said he did not know the reason for the steep fall in its shares.

Another theory doing the round is that financiers sold pledged shares of a trader who had been banned by Sebi in the past and is known for his interest is some of the above stocks. Lenders also sold shares of a Mumbai-based broker past his prime, said brokers. It is also said that the majority of the funding has been done by some deep-pocketed financiers from Kolkata.

As selling triggered by margin calls happen when shares are already falling, the pace of decline is quick and steep. Brokers said when margin-related selling happens in large numbers, it has a cascading impact on the market, even on unrelated shares. The decline in mid-cap and small-cap shares of late has caught several operators unawares, forcing their financiers to dump the stock. The buzz is that most operators and large traders have been trimming their holdings in the past three weeks, in the run-up to the Union Budget on Thursday.

For the quarter ended December 31, the value of pledged shares as a percentage of the market cap of stocks of the companies with pledged shares fell to 10 per cent, said a report from Morgan Stanley. Of the 813 companies which had reported pledging in September 2012, about 20 have revoked these. An additional 30 companies reported fresh promoter pledging during December, said the report.

)

)