Market drop for third straight week

FIIs pull out nearly $500 million in three weeks as QE nears end

BS Reporter Mumbai A sharp sell-off by foreign institutional investors (FIIs), on concerns that the US quantitative easing (QE) programme is nearing its end, pulled back Indian equities on Friday. Investor sentiment also turned bearish on worries of sluggish growth in Europe and China.

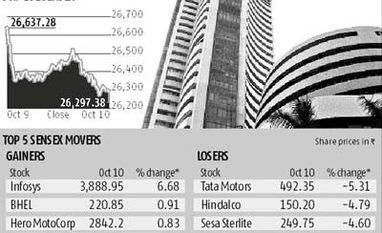

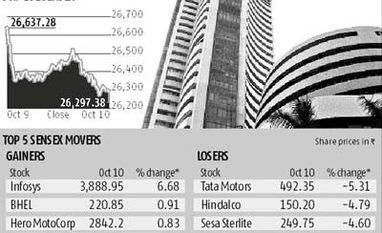

The benchmark Sensex on Friday posted its biggest fall in nearly three weeks despite a seven per cent rally in index heavyweight Infosys following its second-quarter earnings announcement.

The BSE Sensex fell by nearly 340 points, or 1.3 per cent, to close at 26,297, while the Nifty declined 100 points, or 1.26 per cent, to 7,859,95. The cut would have been deeper if not for Infosys, which added 132 points of gains to the Sensex.

The Indian market also ended with losses for the third straight week, losing nearly three per cent.

According to provisional figures provided by stock exchanges, FIIs sold shares worth Rs 720 crore on Friday. Foreign investors have pulled out nearly $500 million (over Rs 3,000 crore) from Indian stocks in a little over three weeks.

Market experts say foreign investors are pulling back ahead of the end of the US bond buying programme. Economists expect the US Federal Reserve to stop buying bonds, or end its QE programme, at the end of this month. Market players, however, say the bigger concern is the first interest rate increase in the US, which is slated for next year.

Most other Asian markets declined more than one per cent, while Hong Kong’s Hang Seng fell two per cent on cancellation of talks in Hong Kong between pro-democracy protesters and the government.

Most European indices were trading over a per cent lower after the IMF cut its growth forecast for the region.

Analysts say Indian markets remain vulnerable, given the high valuations. “The market is significantly exuberant in terms of valuations. Results in this and the following quarters will disappoint because of the expectations built into the valuations,” said Dhananjay Sinha, co-head (institutional research), Emkay Global Financial Services.

Dipen Shah, senior vice-president of Kotak Securities, believes that the long-term outlook for the country remains positive but events in the global markets would have a higher impact on Indian equities in the short term. Barring IT, most sectoral indices on the BSE ended the day in the red.

Shares of NDTV soar 50% in 4 days Shares of NDTV gained 17 per cent on Friday as the benchmark indices corrected about a per cent. The stock has surged 50 per cent in four trading sessions, taking its market capitalisation past the Rs 900 crore-mark. In the past two sessions, trading volumes in the NDTV counter have jumped about five times, compared to its average daily volumes in September, signalling rising investor interest in the stock.

)

)