Market slump begins to bite India Inc's fund-raising

The Baba Kalyani-led company was raising this money to reduce debt

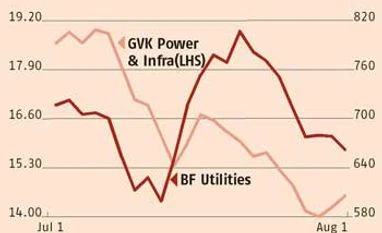

Rajesh BhayaniJoydeep GhoshSamie Modak Mumbai Just a couple of weeks ago, the going was good for India Inc's fund-raising plans. But the recent correction is beginning to hurt plans of companies such as BF Utilities and GVK. GVK's qualified institutional placement (QIP) of Rs 1,500 crore hasn't got good response. Similarly, BF Utilities' QIP of Rs 500 crore has run into rough weather, say market sources. The Baba Kalyani-led company was raising this money to reduce debt. Even foreign institutions are now selling the stock aggressively as response to the QIP has been tepid and the stock price is down 18 per cent in the past two weeks.

Companies in a fix over FMPs The Union Budget's new tax rule on debt funds is likely to hurt India Inc quite badly. Market sources said that while mutual funds were asking retail investors to convert their one-year fixed maturity plans to three-year schemes, companies are unsure if they should do it because if they roll over the scheme, they cannot show it in their books as income. On the other hand, if they redeem it they will have to pay tax on the interest. Many companies, as a result, may be forced to exit FMPs, say market players.

Punters may have a field day with new stocks on BSE From Monday onwards, traders will have more stocks to play with. The Bombay Stock Exchange (BSE) has shifted 500 new companies from the trade-for-trade segment to the normal trading segment, thereby enabling intra-day trading in them. Brokers say that many of these stocks such as NIIT, Punj Lloyd, Gati, Welspun India and BEML are favourites of the trading community. This could lead to volatility in these stocks. "Punters will have a field day. A lot of the stocks were previously traders' favourite," said a broker.

)

)