Market surges 1.2% on rate cut hopes

The BSE's benchmark index, the Sensex, was up 231.59 points or about 1.2%, to close at 19,735.77

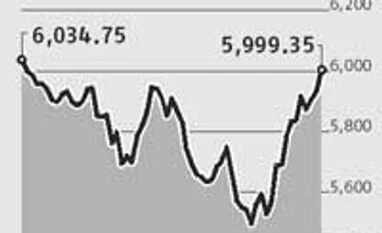

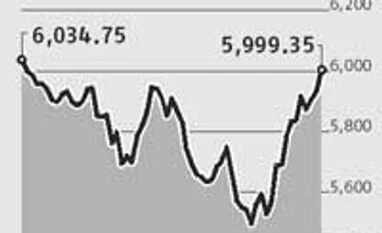

BS Reporter Mumbai The National Stock Exchange’s benchmark Nifty index closed just short of the 6,000 mark on the back of expectations of a reduction in lending rates, ahead of the Reserve Bank of India (RBI) review of monetary policy tomorrow. It closed at 5,999.35, having gained 69.15 points or 1.2 per cent. The BSE’s benchmark index, the Sensex, was up 231.59 points or about 1.2 per cent, to close at 19,735.77.

RBI is set to announce on Friday whether it would cut interest rates. Analysts expect that the repo rate, at which the banks borrow money from RBI, would be cut by 25 basis points (bps). The Cash Reserve Ratio (CRR), the proportion of total deposits banks have to keep with RBI in cash, might also see some easing, say some.

Anish Damania, business head, institutional equity, at Emkay Global Financial Services, said the market was up on the back of expectations on what RBI would do. “The Bank Nifty was up, as were interest rate-sensitive sectors. We are expecting a 25-bps cut in interest rates,” he said.

Prateek Agrawal, chief investment officer at ASK Investment Managers, suggested the central bank might even do more to help with the liquidity situation. “The expectation is that there would be a 25-bps cut, but one could possibly see more. One might also see a CRR cut of 25 bps,” he said

Interest rate-sensitive sectors were among the major gainers today. Indices tracking the banking, capital goods and real estate sectors, all of which would benefit from an interest rate cut, ended with gains between 1-1.6 per cent. Foreign institutional investors were net buyers by Rs 1,430 crore today, according to provisional exchange figures. Domestic institutional investors were net sellers by Rs 899 crore. Eighteen of the 30 stocks on the Sensex ended with gains.

The NSE’s India Vix, an index of volatility, was up 7.81%.

)

)