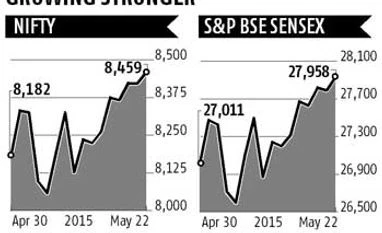

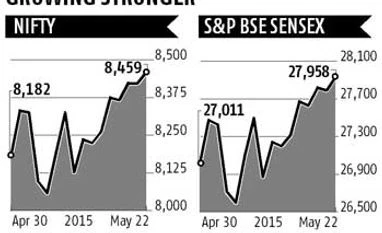

Markets end at 5-week closing highs

BSE Sensex gained 633 points or 2.31% to settle at 27,957

Peter Noronha Mumbai The markets ended at 5-week closing highs, and third consecutive week of gains, on the back of positive global cues, the government's moves to assuage fears on the Minimum Alternate Tax (MAT) front, steady progress of monsoons and hopes of interest rate cut by the RBI at its policy meeting early next month.

In the week ended Friday, 22 May 2015, the BSE Sensex gained 633 points or 2.31 per cent to settle at 27,957 and the Nifty added 196 points or 2.37 per cent to settle at 8,458 to mark their highest closing since April 17 this year. The Sensex had, in fact, reclaimed the 28,000 mark in Friday's session, but was unable to hold on to the psychologically crucial mark.

The broader markets, however, underperformed; the BSE mid-cap index advanced by 55.89 points or 0.52 per cent to end at 10,619 and the BSE small-cap index gained 166 points or 1.5 per cent to settle at 11,207.

KEY EVENTS On the policy front, the government constituted a 3-member AP Shah Committee on Wednesday to resolve the controversial minimum alternate tax (MAT) issue.

In another major initiative, the Union Cabinet on Thursday approved a relaxation of policy on investment proposals from Persons of Indian Origin (PIOs) and Overseas Citizens of India (OCIs), treating them at par with Non-Resident Indians (NRIs) in this regard.

On the macro front, data released by the government on Friday showed that India's merchandise exports declined 13.96 per cent to $22.05 billion in April 2015 compared to April 2014, while imports reduced by 7.48 per cent to $33.04 billion in April 2015 vis-à-vis April 2014.

On the monetary policy front, the Finance Minister Arun Jaitley said that it is time for the Reserve Bank of India (RBI) to cut rates in view of moderation in inflation and subdued industrial growth.

MARKET VIEW

Jayant Manglik, president-retail distribution, Religare Securities, said, "We have been reiterating our cautious view for last one week or so and extending the same for the next week as well. Lack of broader participation is one of key reason for prevailing uncertainty in the market and due to ongoing earning season, this bias may prolong further."

According to Vinod Nair, head-Fundamental Research, Geojit BNP Paribas Financial Services, "This week, we saw markets edging higher on rate cut hopes despite volatility brought by Q4 results of heavyweights. Such volatility is likely to continue as about 40 per cent of Sensex constituent's results are awaited."

SECTORS AND STOCKS

The week clearly belonged to the IT and pharma pack, with the two sectoral indices zooming by 4.7 per cent and 3.3 per cent respectively. The capital goods and banking indices gained around 1 per cent each. The metal pack was the sole weak spot, edging marginally lower by 0.2 per cent.

In the IT space, Wipro, TCS and Tech Mahindra strengthened by more than 8 per cent each, and Infosys gained 1 per cent, on the back of a strengthening dollar.

In the pharma space, Wockhardt, Sun Pharma, Torrent Pharma and Strides Arcolab gained 5-10 per cent each. In the banking space, SBI ended higher by 3.1 per cent at Rs 287. The bank's net profit jumped 23.06 per cent to Rs 3742.02 crore on 14.54 per cent increase in total income to Rs 48616.41 crore in Q4 March 2015 over Q4 March 2014. In the midcap space, Zee Entertainment soared by 9 per cent, while Yes Bank and Wockhardt gained 4-6 per cent each.

WEEK AHEAD

The trend in global markets and the impending F&O expiry on Thurday will be important factors in the week ahead. Dalal Street could receive a further boost if the global market cues continue to be positive. the markets could turn volatile ahead of the derivatives expiry on Thursday.

)

)