Markets register biggest advance in over three weeks

Weak US jobs data boosted risk appetite by dimming chances of Fed rate raise

Samie Modak Mumbai The markets posted their biggest advance in over three weeks on Monday, buoyed by global cues amid a rise in oil prices.

Weak US jobs data on Friday boosted risk appetite by dimming the prospects of an interest rate hike by the US Federal Reserve in June.

The benchmark Sensex closed at 25,688.86, up 460.36 points or 1.82 per cent, the most since April 13. The NSE Nifty climbed 132.6 points, or 1.71 per cent, to settle at 7,866, led by gains in automobile and banking stocks.

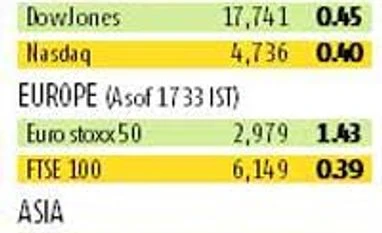

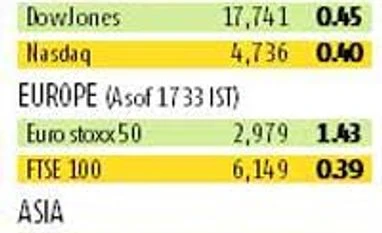

Most global markets posted gains on Monday, defying subdued trade data from China, which led to a 2.8 per cent fall in the Shanghai Composite Index. The rally in equities caused a decline in gold prices.

Brent crude oil prices climbed to around $45 a barrel after wildfire affected output in Canada’s oil sands region and a change of guard in the Saudi oil ministry.

According to Bloomberg, the odds that the Fed will increase rates in June are just eight per cent. A delayed rate increase bodes well for emerging markets.

“The main reason behind the jubilation was weaker than expected US jobs, which increases hope of an accommodative stance by the Fed,” said Jayant Manglik, president, retail distribution, Religare Securities.

Foreign and domestic investors were buyers on Monday, provisional data provided by the stock exchanges showed. Foreign institutional investors (FIIs) bought shares worth Rs 224 crore, while domestic institutions, too, purchased shares worth Rs 350 crore.

Inflows of Rs 4,400 crore into equity mutual funds in April have provided fund managers more powder to purchase stocks.

Experts said positive earnings announcements by India Inc in the quarter ended March had improved sentiment. Hindustan Unilever and HDFC are among the blue-chip stocks that have beat analysts’ expectations. Market players said rate-sensitive stocks were gaining on hopes that the bankruptcy Bill would be passed. Axis Bank, ICICI Bank and the State Bank of India were among the biggest gainers on Monday, rising by two to three per cent.

Automobile companies Bajaj Auto and Hero Motocorp gained 3.8 per cent and 2.2 per cent, respectively. Global sentiment has led to a 12 per cent rally in Indian equities since March. The high valuations provide little room for a further rise, some experts said. “The Nifty now trades at 16.5 times our 2016-17 estimated earnings, which is 1x standard deviation to its long-term mean of 14.5 times. Concerns about increasing global volatility, upcoming events like Brexit, and central banks’ monetary policy increase the risks,” said Naveen Kulkarni, co-head of research, PhilipCapital.

The brokerage has set a year-end target of 8,500 for the Nifty, implying an eight per cent upside from current levels.

)

)