Markets rattled by fresh GAAR fears

Sensex loses 348 points to close with biggest weekly fall since December 2011

BS Reporter Mumbai Confusion surrounding the implementation of the controversial General Anti-Avoidance Rules (GAAR) sparked panic selling among foreign investors, which saw the benchmark Sensex dropping nearly 350 points on Friday. Profit-booking by investors, following a lack of big reform announcements in the Union Budget, also contributed to the fall. Heavy selling was seen, particularly in shares that had run up sharply belying fundamentals in the weeks leading up to the Budget.

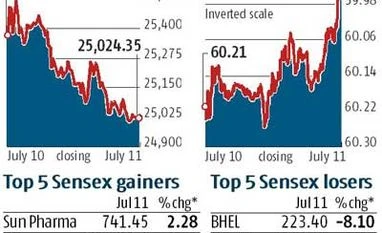

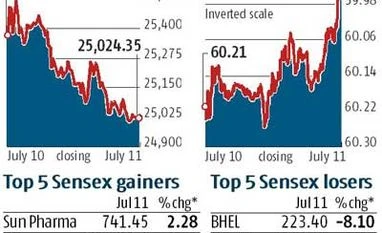

The Sensex declined 1.4 per cent, or 348 points to 25,024.35, while the Nifty declined 7,459.6, down 1.43 per cent, or 108.15 points, on Friday.

Foreign investors were pinning hopes on deferred applicability of the tax anti-avoidance law by another year to 2016. Comments by Nirmala Sitharaman, minister of state for finance, that GAAR would be applicable from April 1, 2015 led to a sell-off, said market players. The Budget was silent on the implementation of GAAR.

Foreign investors sold shares worth more than Rs 700 crore on worries surrounding GAAR. The benchmark indices, which fell for a fourth straight day, posted their worst weekly performance since December 2011, declining almost 4 per cent. Realty, power, banking and capital goods stocks led the decline.

"Valuations had become stretched for the entire market. Over two-thirds of individual stocks had become expensive. Smart investors took money off high-beta and momentum stocks as the run-up in individual stocks won't reflect in the June quarter results," said G Chokkalingam, managing director of Equinomics Research and Advisory.

Analysts said markets would now take cues from the monsoon and the June quarter earnings, making stocks vulnerable to any disappointment.

"With the big event behind, the market focus will shift back to fundamentals. Earnings growth and interest rate expectations are critical triggers. While monsoon failure is a risk, it can be mitigated through pro-active government policies," said a client note by Edelweiss.

The BSE Smallcap and Midcap indices underperformed the benchmarks, declining about 3 per cent each. Eight of the 12 sectoral indices ended with losses, with realty and capital goods declining the most by about 5 per cent each. The BSE Banking index fell 2.7 per cent, led by State Bank of India (SBI), which dropped 5 per cent. Banking stocks took a beating after benchmark yields soared to near two-month highs.

The negative sentiment notwithstanding, brokerages remained positive on the market prospectus over the medium term. "Overall, we continue to remain bullish on the markets and maintain our index target of 27,000 by the year-end, though in the near term we could see some consolidation due to the monsoon," wrote Jyotivardhan Jaipuria, head of India research, Bank of America-Merrill Lynch in a note.

A report by Kotak Institutional Equities said the market would see consolidation in the ongoing quarter, and "restart its upward trajectory from the December quarter onwards". "This is healthy consolidation, which might continue. Once it is done, quality stocks will again start doing well," said Chokkalingam.

)

)