Markets wave caution flag over Fed worries

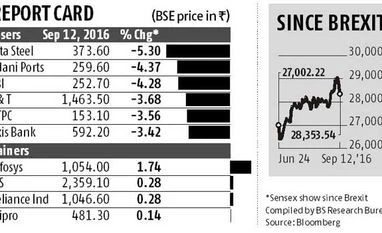

Biggest decline since Brexit

Samie Modak Mumbai The Indian markets on Monday posted their biggest decline since the Brexit day over rate hike fears by the US Federal Reserve later this month. European Central Bank (ECB) President Mario Draghi's comments over additional stimulus support also hurt investor sentiment and raised doubts over how long the central bank's loose monetary stance to support economic growth would continue.

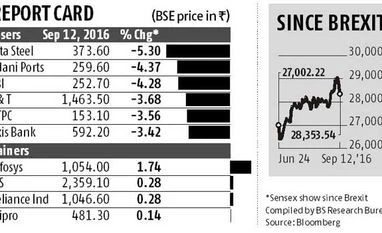

After falling as much as 545 points, the BSE Sensex settled at 28,353.5, down 443.7 points, or 1.54 per cent. The Nifty 50 index dropped 151 points, or 1.7 per cent, to end at 8,715.6. Both indices posted their biggest single-day decline since June 24, the Brexit aftermath day. The broader markets witnessed a steeper fall, with the BSE Midcap and Smallcap giving up almost three per cent each, most in six months.

Most global markets saw sharp cuts, with Hong Kong's Hang Seng declining 3.4 per cent and Japan's Nikkei 225 losing 1.7 per cent. European markets, too, traded over two per cent down on opening. The MSCI Emerging Market index fell two per cent on fears that foreign investors might pull back their investments if the US central bank raises rates. Oil prices continued to slide as investors switched to risk-off mode. The latest trigger being the comments by a Fed member that the central bank shouldn't wait too long to raise interest rates.

"Decline in the market is largely due to concerns about rate hike by the US Fed. Markets were earlier expecting a hike in December but now various reports suggest a hike call can be taken in September itself," said U R Bhat, managing director, Dalton Capital Advisors (India).

Foreign portfolio institutions (FPIs) sold equities worth nearly Rs 600 crore ($89 million) on Monday, according to provisional data available on stock exchanges. On the other hand, domestic institutional investors (DIIs) sold equities worth Rs 13 crore. Back home, metal, automobile, and banking shares were the biggest losers as their sectoral indices lost 4.3 per cent, 2.6 per cent, and 2.4 per cent, respectively. Among the Sensex constituents, Tata Steel, Adani Ports, and State Bank of India were the biggest losers, each declining more than four per cent. Meanwhile, several stocks on the BSE 500 index fell a sharp seven per cent or more.

Last week, the Nifty 50 index was only 0.4 per cent away from a new record high, while the Midcap and the BSE 500 indices scaled new highs. The sharp gains in the stocks over the past few weeks were on the back of strong flows from foreign investors as global central banks vowed to support economic growth. Market players said the sharp run-up in markets and high valuations make them vulnerable to any adverse developments, which cause a risk-off sentiment among foreign investors.

In valuation terms, Indian equities continue to be most expensive among emerging markets and other Asian markets.

The one year forward price to earnings(P/E) of Sensex currently stands at 18.05 times while the recent rally in the Midcap stocks has pushed the P/E estimates of MidCap index to 22.78 times. However, other EM peers are currently valued in the range of 11 times to 12 times. While Taiwan's Taiex is valued at 13.36 times, South Korea's Kospi is valued at 11.06 times, Bloomberg data showed.

Experts said global cues may continue to play a decisive role on the performance Indian markets, certain domestic factors too hold key.

"Revival in the corporate earnings and extent of monsoon would play a vital role in deciding the direction of Indian equity markets," said Bhat.

)

)