MCX sees delivery of 106,814 tns in 5 base metal contracts since Jan 2019

Out of the total deliveries of metal, aluminium accounted for 30,771 tonnes, copper 24,852.50 tonnes, lead 10,517 tonnes, nickel 3,646.50 tonnes and zinc 37,027 tonnes

)

Explore Business Standard

Out of the total deliveries of metal, aluminium accounted for 30,771 tonnes, copper 24,852.50 tonnes, lead 10,517 tonnes, nickel 3,646.50 tonnes and zinc 37,027 tonnes

)

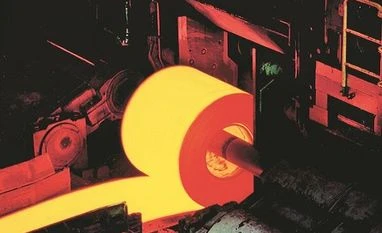

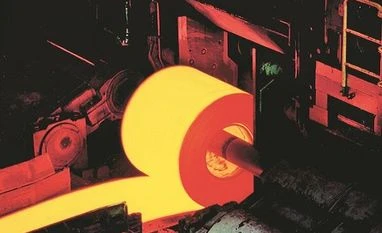

The Multi Commodity Exchange of India (MCX) on Monday said it has witnessed a total delivery of 1,06,814 tonnes in five base metal contracts since January 2019.

These five base metals aluminium, copper, lead, nickel and zinc were converted into compulsory delivery contracts in a phased manner since January last year, the MCX said in a statement.

Out of the total deliveries of metal, aluminium accounted for 30,771 tonnes, copper 24,852.50 tonnes, lead 10,517 tonnes, nickel 3,646.50 tonnes and zinc 37,027 tonnes after completion of their August contract delivery cycle.

Significantly, nickel witnessed the highest-ever delivery of 999 tonnes during this August cycle, the MCX added.

The MCX has also started the process of empanelment of domestic refined lead brands to encourage more domestic consumers and refiners to participate on the exchange, it stated.

For this purpose, the exchange has issued eligibility criteria for domestically refined lead brands to get registered for the MCX good delivery, it said adding that currently, only London Metal Exchange-approved brands are accepted.

"We have achieved yet another milestone by converting all base metal contracts successfully into deliverable contracts within a short time span. We are encouraged by the ready acceptance to the change by the market participants," MCX CEO and Managing Director P S Reddy said.

He added that the Exchange remains keen to explore different aspects of contracts to increase its relevance to the domestic metal industry.

During August 2020, on an average, daily 1,24,638 tonnes of metals valued at Rs 7,270 crore traded on the exchange.

Currently, trading or delivery lots for metals are: 5 tonnes for aluminium, copper (2.5 tonnes), lead (5 tonnes), nickel (1.5 tonnes) and zinc (5 tonnes).

The MCX has designated warehouses at Bhiwandi in Maharashtra and Chennai in Tamil Nadu for the metal delivery.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Sep 21 2020 | 5:44 PM IST