MCX sees options volumes growing to 60% of underlying futures in 6 months

While gold options have risen sharply in turnover the past two months via liquidity enhancement scheme, options in other commodities have been lackluster

)

Explore Business Standard

While gold options have risen sharply in turnover the past two months via liquidity enhancement scheme, options in other commodities have been lackluster

)

India's largest commodity futures trading platform, the Multi Commodity Exchange of India (MCX), expects "options" volumes to grow to a minimum of 60 per cent of underlying futures contracts within six months.

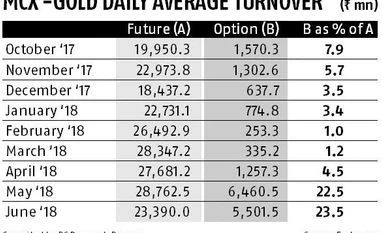

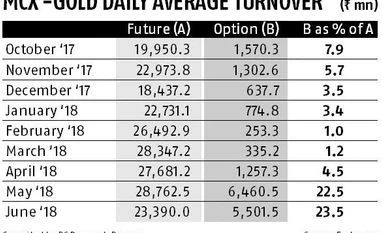

While gold options were launched in October 2017, the options basket was expanded during the past month or so, with the addition of other non-agri commodities such as silver, copper, zinc and crude oil. Other commodities are yet to see their first settlement and hence the response from traders is limited. Gold options recorded a daily average turnover of Rs 1,570.30 million when launched in last October, but the initial euphoria died down and trading fell to around 15 per cent of that level in February.

In order to boost volumes in this segment, the Securities and Exchange Board of India (Sebi) allowed market making in gold options, The move paid off, and daily average turnover exceeded Rs 6,460.5 million in May. In June (up to the 21st), however, the daily average turnover under gold options declined again to Rs 5,501.5 million. With this, volume under gold options jumped to 23.5 per cent of underlying gold futures.

"Any contract takes at least 18-24 months to become successful. A good international benchmark is an options-to-futures ratio of 60 per cent," said Mrugank Paranjape, Managing Director and Chief Executive Officer, MCX, on the sidelines of the Commodity, Equity Outlook seminar in Mumbai on Friday.

While gold options have risen significantly in turnover the past two months through liquidity enhancement scheme, options volumes in other commodities remained lackluster. Contracts in silver, crude oil and copper are in the initial stage of traders' acceptance with options-to- futures ratio in the 2-3 per cent range. The exchange launched zinc options two days ago.

"In some options contracts, we have clocked a turnover of Rs 1-2 billion. Hence, we consider response very good," said Paranjape.

Apart from options contracts, MCX is working on extensively to expand its presence in the agri segment after finding success in crude palm oil (CPO), mentha oil and cotton. The exchange plans to engage 10-12 Farmer Producer Organizations (FPOs) in Maharashtra's Vidarbha, also known as farmers' suicide capital in India, for the direct benefit of the region's cotton farmers.

The overall daily average turnover of MCX has risen from around Rs 210 billion post crisis on the exchange in 2013 to Rs 240 billion currently.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Jun 23 2018 | 10:27 PM IST