More gains needed to confirm an uptrend

Devangshu DattaSentiment seemed strong where Indian stocks were concerned, with a surge on Monday. Q4 results are looking good so far, with quite a few positive surprises. However, the global situation still seemed to cause concern with weakness in China and signs of slowdown in the US also. India-investors are also focussed on politics where the logjam continues, what with the Agusta scandal, the Uttarakhand imbroglio and assembly elections are also in progress.

The Nifty continues to hover quite close to its own 200-Day Moving Average (200-DMA). It moved above briefly and then it slid below and it has just about moved above the 200-DMA again. This volatile behaviour means that it is still hard to definitively call the long-term trend bullish. The long-term trend does seem to have turned up since volume and breadth indicators look positive.

But, this cannot be confirmed until the Nifty moves, say three per cent (200 points or so) above the 200-DMA. The Nifty has so far failed to cross resistance at around 8,000 and a pullback below the 200-DMA (now at around 7,850) could mean that the entire rally from 6,825 till 7,990 terminates. In terms of Fibonacci retracement levels, that Post-Budget rally of eight weeks could see a retracement till 7,550 (first level) or till 7,400.

The net institutional attitude has been neutral through May until we saw buying on Monday. The FIIs were moderate sellers last week while the DII were moderate buyers, balancing off at almost zero. The rally has been driven strongly by positive retail sentiment. If the FIIs do come in this week, their buying could give decisive impetus to the trend. The rupee has strengthened slightly against dollar but the yen has gained versus rupee.

The Nifty Bank has done well despite mixed results and high provisioning from banks. The Nifty Bank is high-beta and a strangle with a long 16,500p (181), long 17,000c (193) is nearly zero-delta with the Nifty Bank at 16,686. This costs 375 and has breakevens at roughly 16,125, 17,374, so either end could be hit and go into profit if there are two big trending sessions.

Open interest (OI) in the Nifty call option chain for May has a big peak at 8,200c and then tapers off but there is reasonably good OI until 8,500c. The May put chain has big peaks at 7,800p, 7,700p, 7,500p and 7,000p. The Nifty's put-call ratios look oversold at around 0.85 (May PCR) to 0.9 (3-month PCR).

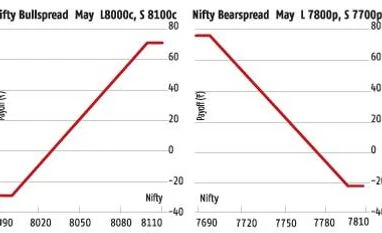

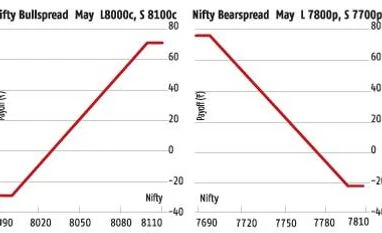

The Nifty closed at 7,866 on Monday with a futures premium of about 45. A bullspread of long May 7,900c (104) short 8,000c (60) costs 44 and pays a maximum 56 and it's about 35 points from money. A wider long 8,000c (60), short 8,100c (31) costs 29 and pays a maximum 71. A bearspread of long 7,800p (62), short 7,700p (37) costs 25 and pays a maximum 75. This is 66 points from the money.

A combined set of long-short strangles such as a long 8,000c, long 7,800p, short 8,100c, short 7,700p costs 54 and pays a maximum 46. But, this is asymmetric, with the puts considerably closer to money and therefore, not a very attractive position logically.

A trader who expect 8,000 to be tested but don't expect the 8,000 resistance to break easily, could consider creating a butterfly spread with one long 7,900c (104), two short 8,000c (2x60) and one long 8,100c (31). This 4-call position costs a net maximum of 15. It will start becoming profitable at above 7,915, with a peak profitability of 85 at 8,000. It would remain profitable unless the Nifty moved beyond 8,085.

)

)