Mutual funds (MFs) led by Franklin Templeton, which has the highest exposure of Rs 1,244 crore through its debt schemes in the promoter entities of Anil Ambani group companies, will have to either seek higher collateral by way of topping-up of shares from promoter entities or risk lowering values of their schemes.

According to data from Value Research, mutual funds’ exposure to the debt papers of Anil Ambani’s Reliance group’s promoter entities — Reliance Infrastructure Consulting & Engineers, Reliance Big Entertainment and Reliance Big — stood at Rs 1,418 crore as on December 31, 2018.

These Reliance group companies had borrowed by putting group firms’ listed shares as collateral.

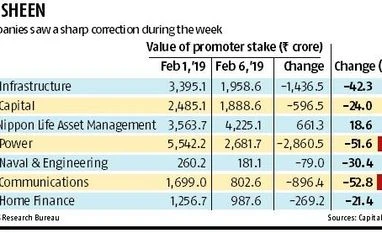

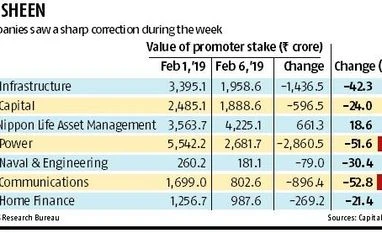

The share prices of Reliance Infrastructure fell by 32 per cent on Wednesday in which promoter entities hold almost half of the equity. Of this, 84 per cent of the stake is pledged to funds and lenders. Similarly, other group companies’ shares also declined, sending a wake-up call to mutual funds.

An e-mail sent to Reliance group seeking a comment did not elicit any response.

“The cash top-up available in these transactions was used to reduce outstanding exposure and the transactions remain adequately covered. We continue to engage with the company,” a Franklin Templeton spokesperson said. According to sources, Indiabulls MF this week used the cash top-up available to reduce its outstanding exposures to Rs 14 crore from Rs 25 crore.

“Our exposure in the case of Reliance Big Entertainment is secured primarily by collateral of equity shares of Reliance Capital. Our outstanding exposure has already been reduced in the last few days by utilising existing cash in the structure to retire over 40 per cent of the debentures. We are comfortable with our security cover at this point of time,” a spokesperson for DHFL Pramerica MF said.

The fall in share prices of Anil Ambani group companies was triggered by the news that the group’s telecom company Reliance Communications (RCom) will file for insolvency at the National Company Law Tribunal (NCLT). The Supreme Court is expected to hear a petition filed by Ericsson, one of the operational creditors, on February 12.

Franklin Templeton MF held its Reliance group exposure in five of its schemes — Franklin India Low Duration Fund, Franklin India Short Term Income, Franklin India Credit Risk Fund, Franklin India Dynamic Accrual Fund and Franklin India Income Opportunities Fund – as on December 2018.

DHFL Pramerica MF’s exposure stood at Rs 149 crore, while Indiabulls MF’s exposure was below Rs 25 crore as on December 31, 2018. Analysts said the sharp fall in share prices of Anil Ambani group companies could mean that the collateral may need to be enhanced.

According to a note by Brickworks Ratings in August last year, the overall security cover for the collateral must be always close to two times the debt, of which 0.7 times will be of equity shares of Reliance Capital, 0.3 times of Reliance Home Finance or Reliance Capital, 0.75 times of Reliance Infrastructure and the balance 0.25 times of Reliance Power.

This security cover structure pertains to non-convertible debentures of Reliance Big and Reliance Infrastructure Consulting & Engineers.

In case the share security cover from the combination of listed shares drops below 1.8 times on any day, then the share top-up clause will be triggered and the promoter group will be obliged to provide top-up in the form of additional pledge or cash within two business days such that the cover is restored to two times, the rating firm had said.

)

)