Nifty could fall further if support at 8,050 breaks

Devangshu DattaThe stock market correction continued through Tuesday, with the indices registering steep falls. Foreign traders are waiting for the US Federal Reserve to conclude its last policy meeting of 2014. This will be followed by a Bank of Japan policy announcement.

A strong dollar and weakening growth rates in China and Japan, coupled with recessive conditions in Europe, have led to jitters. Weak trade data from China and weak global gross domestic product (GDP) estimates have led to crude oil falling to multi-year lows, alongside downtrends in non-precious metals.

The Nifty has fallen 500 points from its all-time high of 8,627. It could fall further if supports in the 8,050-zone are broken. The Reserve Bank of India (RBI) has tough decisions to make. Inflation has dipped and GDP growth has softened, leading to domestic pressure to cut interest rates. But the rupee is under pressure versus the dollar and the trade deficit is growing. A rate cut could lead to the rupee sliding further.

This is the financial year-end for most foreign institutional investors (FIIs) and there is a historic pattern of profit-booking during the last fortnight of December. That profit-booking could occur even if the Fed makes dovish policy. But a dovish Fed would positively influence 2015's emerging-market allocations.

The Nifty had moved quickly from 7,900 to over 8,600. This has re-traced most of that 700-point zone. Short-term traders should assume support/resistance levels exist at 50-point intervals. On the upside, the Nifty would have to bear 8,627 to confirm an end to the correction and a continuation of the long-term bull market.

The Bank Nifty and other financials were the main drivers of the rally. The Bank Nifty seems to have cracked, moving below the psychological 18,000. It could fall to 17,500 or lower in three to five sessions. Short-term traders should assume support/resistance zones at 150-point intervals on the BankNifty.

Despite the stronger dollar, export-oriented stocks have seen sharp corrections. The fear is demand for their services may have contracted. But given the currency situation, a weaker rupee should lead to a bounce. The passing of Bills could be a bullish signal. Assembly election results could be a news-based positive for rallies, or corrections, depending on the Bharatiya Janata Party's performance.

The Nifty's Put-Call ratios (PCR) are in the danger zone. The three-month PCR is 0.79 while the Dec PCR is 0.89. Anything below one is bearish. The speed of the slide has meant bulls and bears have been caught unprepared.

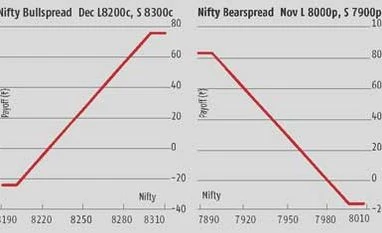

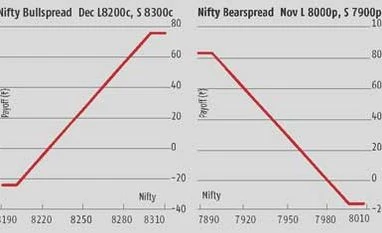

The December Nifty Call chain has open interest (OI) peaking between 8,200c and 8,500c. The December Put OI peaks at 8,000 but there's a bulge in OI at 8,200p and ample OI at 7,500p. The support at 8,000 should be strong and there will be resistance above 8,200. The spot Nifty closed at 8,067, with the futures at 8,118. The close-to-money spreads are acceptable but a trader may be tempted to look for wider movements. A close-to-money bullspread of long Dec 8,100c (82) and short 8,200c (40) costs 42 and pays a maximum of 58. A wider spread of long 8,200c and short 8,300c (18) costs 22 and pays 78. A bearspread of long Dec 8,000p (37) and short 7,900p (19) costs 18 and has a maximum pay-off of 82. The close-to-money bearspread has a better risk:reward ratio. A trader could combine the long 8,200c and long 8,000p and short 8,300c and short 7,900p. This long-short strangle combination costs 41 and break-evens are at 7,959 and 8,241. It is not zero-delta since the calls are further from money.

)

)