Nifty may test 5,565

Nifty's current support is at 5,650, with interim support at 5,675 and 5,700

Devangshu Datta New Delhi The market tested support at lower levels and those held. Monday gave hopes of a small interim rally. However, the intermediate and long-term trend appear down. Optimists are hoping Federal Reserve will postpone tapering of QE3 due to weak US employment data. But FIIs seem decided to cut exposure.

Even when FIIs have bought, they have dealt in very small volumes. The dollar has tested support below 61; it may be temporary. Domestic institutions have been cautious. Q1 results remain mediocre.

Breadth was poor, with advances outnumbered by declines even on Monday when the Nifty rose, breaking an eight session downtrend. Debt has seen bond yields climbing and three treasury auctions have devolved in succession.

The NSEL crisis was another trigger point for potential panic and it could still have repercussions. Turmoil in the monsoon session could be bearish. It is still relatively early in the settlement and Nifty and Bank Nifty futures are trending at large premiums to spot rates.

The Nifty has dropped from a July high of 6,093 to a recent low of 5,649. The Bank Nifty dropped from 11,700 to 9,818, just off its 52-week low of 9,814. Both bounced from those levels but a pattern of lower intermediate lows has been established. Both are below their respective 200 Day Moving Averages (DMA).

The Nifty's current support is at 5,650, with interim support at 5,675 and 5,700. If 5,650 is broken, it could test 5,565, where it bottomed on the last correction. Below 5,565, the next target is 5,480. On the upside, there's heavy resistance between 5,825-5,875, which is the zone of the 200 DMA.

The Bank Nifty will be in a new and highly bearish zone if it breaks below 9800. Current support exists at 10050, and below at 9950. On the upside, there's resistance at 10300 and again at 10450. A short position here is marked. Our earlier recommendation of a Bank Nifty bearspread has already gained but it's still worth holding. A long 10000p (255) and a short 9500p (110) costs 145 and pays a maximum of 355.

One point to note is that low volumes means high volatility and any major operator (or FII) could swing the market a lot with relatively low commitments. Volatility is likely to stay high through August. The CNXIT index continues to be a potential outperformer, especially if the USD picks up steam and the INR weakens some more.

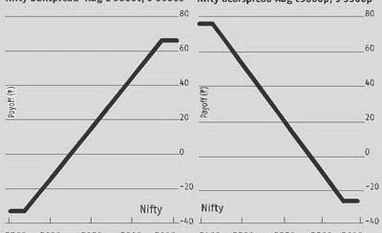

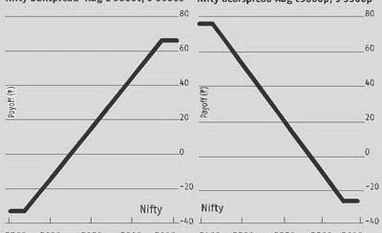

The Nifty itself now has put-call ratios verging on the bearish at around 1. Although a big bounce looks unlikely, a bullspread of long 5800c (77) and short 5900c (42) has a reasonable risk:reward ratio with a maximum payoff of 65 and a cost of 35. A bearspread of long 5600p (70) and short 5500p (44) costs 26 and could pay 74.

A straddle of at the money options of 5700p (126) and 5700c (106) costs 232, with breakevens at roughly 5468, 5932. Traders could take the breakeven points of this position as the likely limits of moves this week. Strangles of the Nifty look too expensive.

)

)