Oil rises above $66 as weaker dollar offsets oversupply concern

The dollar was down 0.7 per cent against a basket of currencies

Reuters London Brent crude futures rose above $66 a barrel on Tuesday as a weaker dollar and the Yemen conflict helped lift prices.

Record high oil output from Saudi Arabia in April failed to dent the move, although Goldman Sachs warned of further oil price declines.

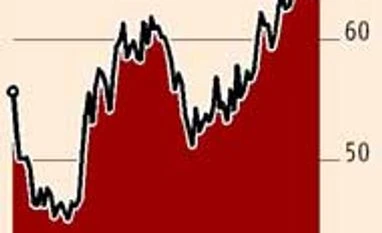

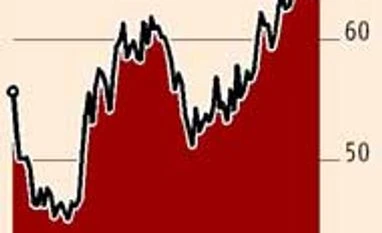

June Brent crude was up $1.34 at $66.25 a barrel by 1000 GMT. June West Texas Intermediate (WTI) rose $1.03 to $60.31 a barrel.

The dollar was down 0.7 per cent against a basket of currencies. Dollar-traded commodities such as oil benefit from a weaker US unit as it makes them cheaper for holders of other currencies.

"We had a strong recovery of the US dollar in the last few trading session but we saw a reverse this morning," said Myrto Sokou, senior analyst at Sucden Financial. "The weaker dollar is providing support for prices."

Top global oil exporter Saudi Arabia raised its crude production in April to a record high, feeding its flourishing Asian market share and its own power plants and refineries.

The world's top oil exporter pumped 10.308 million barrels of oil per day in April, a Gulf industry source told Reuters on Tuesday, compared to 10.29 million bpd in March. "This is an indication of strong demand, especially from Asia, as well as increasing domestic consumption during summer," the source said.

Saudi-led air strikes pounded the Yemeni capital Sanaa on Tuesday, hours before a five-day truce was set to begin between the alliance of Gulf Arab nations and the Iran-allied Houthi militia that controls much of the country.

While Yemen is a marginal oil producer, its proximity to shipping lanes has raised concerns over supply routes.

Brent dropped to a six-year low of $45.19 in January before recovering to a 2015 high of $69.63 last week. But analysts warned that the recovery may be short-lived.

"I think that the global surplus story is still going to persist and that's going to keep a cap on oil prices," said Michael Hewson, chief markets analyst at CMC Markets.

Goldman Sachs said in a note that the price rally itself prevented a reduction of oversupply and would therefore lead to lower prices going forward.

"While low prices precipitated the market rebalancing, we view the recent rally as premature with crude oil prices expensive relative to current and forecast fundamentals," the US investment bank said.

)

)