Oil set for longest rally since April as US stockpiles decline

US inventories decrease 1.23 million barrels, energy agency sees higher global demand for oil in 2015

BloombergOil headed for its longest rally in almost six months as US industry data showed crude stockpiles fell in the world's biggest consumer.

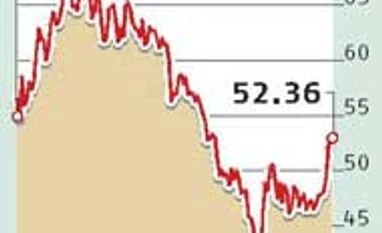

West Texas Intermediate futures rose as much as 2.4 percent in New York, climbing for a fourth day in the longest advance since April. Inventories dropped by 1.23 million barrels last week, the American Petroleum Institute was said to have reported. The decline may have surprised traders and analysts, who predicted in a Bloomberg survey that government data for the period, due Wednesday, will show a stockpile increase.

Oil is trading at the highest level since July in New York, approaching $50 a barrel after advancing 10 per cent since the end of last month. Prices slumped to a six-year low in August amid speculation a global glut will be prolonged. US crude stockpiles remain about 100 million barrels above the five-year average and OPEC continues to pump above its target.

"More supportive oil market fundamentals have driven the rebound in crude," Jens Pedersen, an analyst at Danske Bank A/S in Copenhagen, said by email. "For the recovery to continue, the market needs better key macro figures."

West Texas Intermediate for November delivery climbed as much as $1.18 to $49.71 a barrel on the New York Mercantile Exchange, the highest since July 22, and was at $49.56 at 12.22 pm London time. The contract gained $2.27 to $48.53 on Tuesday. The volume of all futures traded was about 70 percent higher than the 100-day average for the time of day.

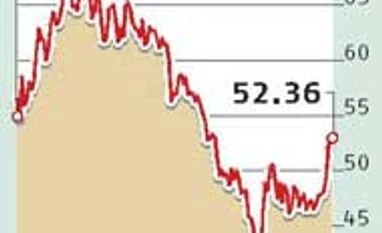

US stockpiles Brent for November settlement rose $1.01 to $52.93 a barrel on the London-based ICE Futures Europe exchange. It increased $2.67 to $51.92 on Tuesday. The European benchmark crude was at a premium of $3.32 to WTI.

Crude stockpiles at Cushing, Oklahoma, the delivery point for WTI contracts and the biggest US oil-storage hub, dropped by 100,000 barrels through October 2, the API said on Tuesday, based on Twitter postings and a person familiar with the information. Nationwide supplies are forecast to have gained by 2.25 million barrels last week, according to a Bloomberg survey before weekly data from the EIA. Global oil demand is projected to average 93.79 million barrels a day this year, the EIA said on Tuesday in its monthly short-term energy outlook.

That's up from 93.62 million the agency forecast in September. The group trimmed its projections for world crude production this year and in 2016.

0ppThe Organization of Petroleum Exporting Countries isn't in disarray and the market is experiencing a price cycle like those of the past 50 years, OPEC Secretary-General Abdalla Salem El-Badri said at a conference in London on Monday. There is a supply overhang of about 200 million barrels in the market, he said.

)

)