Pledged shares at 8.21% of market cap

Value up from 4.98% in FY11, which translates into a rise of 65% over five years

BS Reporter Mumbai Pledged shares accounted for 8.21 per cent of total market capitalisation at the end of 2015-16, up from only 4.98 per cent in 2010-11, which translates into a rise of 65 per cent over the past five years.

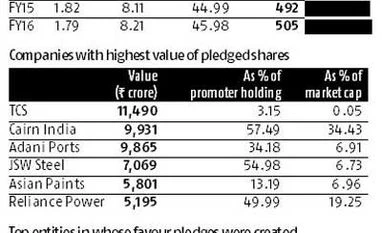

Pledged shares as a percentage of market cap have been rising every year since 2010-11. The value of pledged shares, however, fell from Rs 1.82 lakh crore at the end of 2014-15 to Rs 1.79 lakh crore at the end of 2015-16.

The decline was due to a fall in stock prices. Stock market indices fell nearly 10 per cent in 2015-16.

Pledging shares is when a promoter transfers shares to a lender to get a loan. The lender maintains possession of the pledged shares, but does not have ownership unless default occurs.

According to data available with Prime Database, the average promoter shareholding stood at 45.98 per cent for the universe of companies with at least some shareholding. This has increased from 30.8 per cent at the end of 2010-11.

Average share pledging for all listed companies has increased from 8.21 per cent to 15.25 per cent for the period under consideration.

"The high pledge levels are not considered a good sign by investors as a downturn in the market price can lead to invocation and change in management," said Pranav Haldea, managing director of Prime Database.

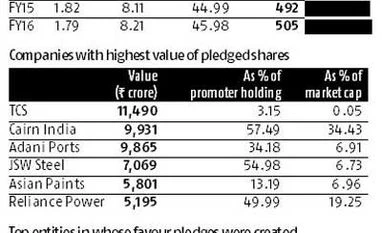

Tata Consultancy Services, Cairn India, Adani Ports & Special Economic Zone and JSW Steel were the among the companies with the highest pledged shares in value. Pledged shares as a percentage of total market cap, however, are not very high for these companies.

On March 31, 2016, shares were pledged in as many as 505 of the 1,514 NSE (National Stock Exchange)-listed companies, up from 492 a year ago.

"This shows that even though pledge levels have gone up, given the fall in the equity markets over the last year, the value has remained constant," Haldea said.

As many as 25 companies had the complete shareholding of the promoters under pledge on March 31, 2016. These include AGC Networks, Arshiya, Bajaj Hindusthan Sugar, Bharati Defence & Infrastructure, DQ Entertainment (International), Eastern Silk Industries, Gokaldas Exports, IL&FS Investment Managers, IVRCL, and JMT Auto.

In another 73 companies, over 90 per cent of the promoters’ shareholding was pledged and in 209 companies over 50 per cent of the promoters’ shareholding was pledged.

Pledged shares were brought down to zero in 39 companies during 2015-16. These include Suryajyoti Spinning Mills, Shri Aster Silicates, GSS Infotech, Jaypee Infratech, Entegra, Golden Tobacco, Mangalam Cement, and GHCL.

There were 180 companies in all in which the percentage of pledged promoter shareholding decreased during 2015-16.

)

)