On a day when the broader markets were down by one per cent, Reliance Communications (RCom) spurted seven per cent on plans to develop the company's real estate parcels in Delhi and Mumbai under a new company, Reliance Properties (R-Prop). The company has pegged the value of these at Rs 12,000 crore or Rs 60 an RCom share.

The company has said the proposed separation of real estate into a separate unit is part of its plan to divest non-core assets and focus on its core wireless and enterprise business. As the surplus land was not used for telecom operations, most analysts (who had not assigned any value to the land) say the demerger is a positive for shareholders.

Analysts at ICICI Direct say while the demerger would have no impact on profitability, it will lead to unlocking of value corresponding to that of R-Prop for shareholders. Research firms have pegged the deal value at Rs 6,000-Rs 6,600 crore, translating to Rs 30-32 an RCom share. Given the lack of clarity on debt, most analysts are neutral on the stock but have increased their target prices (Rs 100-160) in the past week, incorporating the value from the demerger.

The deal The new entity, R-Prop, will develop RCom's surplus realty (135 acres) in Dhirubhai Ambani Knowledge City, Navi Mumbai, translating to saleable area of 15 million sq ft, and its Connaught Place property in Delhi of four acres. RCom has said R-Prop will work with global partners to unlock value from its realty parcels. While the company has not indicated if there would be a transfer of debt, analysts say the new entity could bring in fresh investors and much needed capital.

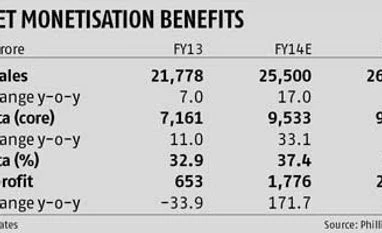

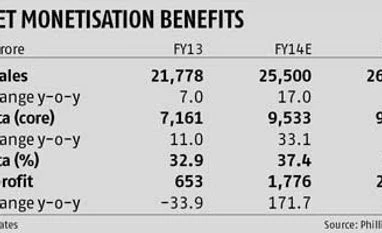

As of now, post-tax value for shareholders is pegged at Rs 30 a share. Say Naveen Kulkarni and Vivekanand Subbaraman of Phillip Capital, "While the company has estimated a value of over Rs 12,000 crore, we adjust the same for taxation and illiquidity and arrive at a realisable value of Rs 6,200 crore, boosting the value of RCom's equity holders by Rs 30 a share."

The research firm says there has been a cumulative addition of Rs 57 to its target price (now pegged at Rs 160), comprising the property deal and Rs 27 a share from the tower deal.

Tackling debt burden

The RCom stock has been on an uptrend after its deals with Reliance Jio, repayment of loans and plans to sell its Direct-to-Home (DTH) television business. The company, which had net debt of Rs 38,864 crore at end-March, could see a reduction of debt after the latest repayment of external commercial borrowing of $1 billion and scheduled repayment of $207 million or about Rs 7,000 crore. Additionally, the company is looking at selling its DTH business for a reported Rs 2,500 crore. If the recent deals with Reliance Jio for sharing of intercity optic fibre network which fetched it Rs 1,200 crore, as well as the proposed intra-city deal (estimated at Rs 3,500 crore), fructify, it should fetch Rs 4,700 crore.

In addition, if the DTH deal (Rs 2,500 crore), as well as the proposed sale of the Globalcom business (Rs 7,000 crore), come through, RCom should be able to bring down debt by about Rs 14,000 crore in FY14. With Rs 38,864 crore of debt, the sale of assets should help bring down debt to about Rs 25,000 crore. Currently, RCom pays about Rs 2,500 crore of interest annually, which should come down to about Rs 1,500 crore, helping save Rs 1,000 crore. While these savings should flow through to the bottom line, the tower deal with Jio should also enhance cash flow, with analysts estimating an inflow of Rs 800 crore annually, boosting operating profits.

Outlook

While the company has taken steps to rein its debt and improve cash flows, there are worries on the operational front as well. Says an analyst, "The problem for RCom, unlike the other two listed entities, is that they have to incur operational expenditure for both networks (CDMA and GSM), and there has not been a marked improvement in operational cash flows, revenue growth, etc, for a number of quarters now. There are a lot of free minutes still left in the system, though the company has been reducing them gradually." Since the March quarter saw an uptick, the June quarter trend will be crucial.

While the company says the peak of capital expenditure intensity is behind it, analysts believe the Rs 1,500 crore capex forecast for FY14 is not going to be adequate, as competitors are investing aggressively. In other words, analysts will be keen to see operational improvement as well before upgrading the stock further.

)

)