Record yield has pulses prices slide below MSP

Trade wants stock limits lifted as prices of most varieties trading below MSP

)

Explore Business Standard

Trade wants stock limits lifted as prices of most varieties trading below MSP

)

Ajay Vir Jakhar, chairman, Bharat Krishak Samaj said: "While the crop is at a record high, farmers are not getting the minimum support price promised by the government. The government should meet its promise of ensuring farmers get the promised MSP."

He suggested an action plan for the government. Firstly, to follow Niti Ayog's proposal of price deficiency system where Ramesh Chand, member agriculture of the Ayog has said that wherever government could not reach for logistical issues for procuring commodity at MSP, the government should pay farmers the loss they incur by selling at prevailing lower prices if farmers can produce proof of loss.

Secondly, he said to increase price stabilisation fund size from Rs 500 crore to Rs 5,000 crore.

"Thirdly, when prices rise and farmers get better realisation, the government promotes imports and later doesn't procure at MSP from farmers when prices fall. This amounts to subsidizing farmers in other countries and hence government should give up promoting imports of agriculture production."

Problem arises when the government machinery is neither able to buy pulses at MSP nor allows traders with funds to store more and hence farmers who grew record pulses are suffering.

However, importers say pulses import contracted in past continues but many importers are losing money and there are cases of defaults in imports also, according to trade sources. Compared to last year's around 6 million tonnes, importers estimate 4-5 million tonnes of imports in the current year.

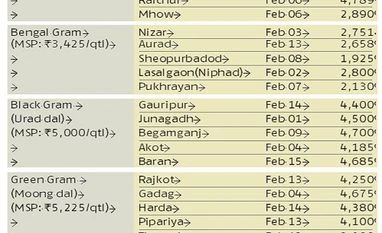

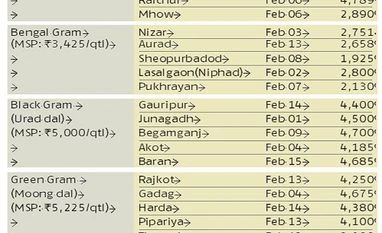

According to the second advance estimate of the ministry of agriculture released yesterday, total production of pulses during 2016-17 is estimated at 22.14 million tonnes which is higher by 5.79 million tonnes from the previous year's production of 16.35 million tonnes. Chana prices at present are at comfortable levels from farmers' point of view but with the arrivals rising, farmers returns will only fall.

Bimal Kothari, vice-chairman of India Pulses and Grain Merchants Association (IPGA), an apex trade body, and managing director of importing firm Pancham International said, "We have written to the government that this is the right time to lift stock limits on pulses and allow its exports."

The suggestion makes sense as the government is not able to ensure MSP to farmers', thus not allowing trade to store more which helps farmers get a better price. He also proposed that government must make efforts to help farmers increase productivity of pulses which is lowest among major producers. India on an average produces 800 kg pulses in one-hectare land while the world average is 3 tonnes.

Kothari said that "government must be finding it difficult to buy pulses at MSP from all mandis and hence when traders are not allowed to stock more, next season farmers will again reduce sowing and the cycle of deficiency will be repeated."

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Feb 17 2017 | 12:21 AM IST