Regulator warns iBanks against overpricing share issues

Move comes amid spate of weak listings due to aggressive pricing

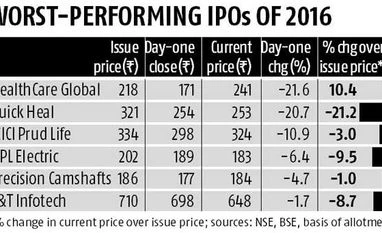

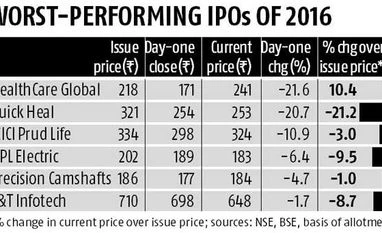

Pavan Burugula Mumbai The Securities and Exchange Board of India (Sebi) has warned investment bankers against aggressive pricing of initial public offerings (IPOs), according to three people close to the development. The move comes amid a spate of weak listings, including that of marquee issues such as those of ICICI Prudential Life Insurance and Larsen & Toubro group companies.

In an informal communication, Sebi has asked investment bankers to leave more money on table for the investors as any adverse stock performance could spoil the positive investor sentiment towards the primary market. The regulator has also told bankers not to get greedy due to good market conditions and availability of liquidity.

Although Sebi has no say on the pricing of any IPO, the step is seen as part of a proactive approach to avoid fleeing of investors especially small investors, who have taken a liking towards the IPO market.

“In 2012, when the IPO markets were positive, a lot of companies had priced their issues aggressively. After listing, a lot of them tanked significantly and investors lost confidence in the market. Following this, the primary markets went into doldrums for over the past two years. The regulator doesn’t want such a situation to repeat,” said an investment banker.

Earlier this month, the shares of ICICI Pru Life had tanked 10 per cent on its listing day. This had disappointed a lot of investors as the Rs 6,000-crore IPO, the biggest in six years, saw good response from retail and wealthy investors. During the IPO, several brokerages had pointed out that ICICI Pru left little money on the table for investors as the insurer valued itself 50 per cent higher than its valuation deal that happened in late 2015. Similarly, IPOs of L&T group companies — L&T Infotech and L&T Technologies — had seen good investor response.

Both IPOs have so far had lukewarm performance after listing, with L&T Infotech trading around nine per cent below its IPO price and L&T Tech down two per cent.

“Most listings this year have been good and this has aided investor sentiment. Sebi is trying to remain ahead of the curve by ensuring exuberance doesn’t set in,” said a regulatory official.

Incidentally, Sebi has asked issuers to highlight the four-five key risk factors prominently in all IPO-related advertisements and communications, with the topmost risk factor being the performance track record of the investment bankers handling the issue.

Investment bankers say generally, the IPO pricing is pegged to existing listed peers and secondary market conditions.

“One of the key factors determining the issue price is the valuations of listed peers. Further, primary markets are interlinked with secondary markets. During a bull run, when there is enough liquidity in the markets, issues tend to be priced higher,” said another investment banker.

Although Sebi doesn’t have a direct say in pricing, this is not the first time Sebi had advised bankers and issuers on pricing. For instance, during Just Dial’s IPO in 2014, the market regulator had asked the company to provide the “safety net” option.

Under this, investors had to be compensated in an event the secondary market price falling below the issue price during the first 90 days after listing. The regulator had even toyed with the idea of making the “safety net” compulsory for all IPOs. However, Sebi scrapped the plan following opposition from market players.

)

)