Rupee, rising yields driving foreign portfolio investors away

In February, FPIs sold $421 mn in debt; in March they have sold $133 mn so far

)

Explore Business Standard

In February, FPIs sold $421 mn in debt; in March they have sold $133 mn so far

)

Foreign investors have slowly started liquidating some of their holdings in local debt paper, as rising bond yields and the rupee's weakening bias make their investment not lucrative enough at a time when the US economy shows early signs of recovery.

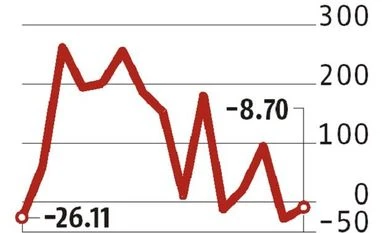

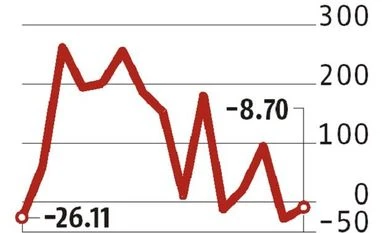

It is not that they are liquidating en masse; utilisation of their permitted limits show there is very little space left to invest. And, this is also a threat for local investors. In February, foreign portfolio investors (FPIs) sold $421 million in debt; in March so far, they have sold $133 mn. However, in January, they had bought $1.5 billion in debt.

FPIs have exhausted 96.66 per cent of their permitted investible limit of Rs 1.913 trillion in government debt. In the case of corporate debt, they have exhausted 99.8 per cent of their limit of Rs 2.253 trn.

However, the sell-off in February should not be seen as an arbitrary case. It could, say bond market experts, be seen as a precursor of things to come. Here's why:

For a foreign investor, returns are as important as the exchange rate. India's exchange rate has been remarkably stable or has strengthened in the past two years. A foreign investor gains more if the local currency appreciates and loses when it currency depreciates. The rupee was 68 a dollar in January 2017; it had strengthened to 63.6 by January 2018.

Much of this was possible because of broad-based dollar weakness. The dollar index, now below 90, is at more than a three-year low. However, it does seem there will not be much if a fall from this level. Recent tariff-induced trade wars and a recovering US economy would mean the dollar could strengthen. That would be bad news for foreign investors converting their currency into the rupee, said Soumyajit Niyogi, associate director at India Ratings and Research.

Bond yields are also rising globally. With the recent liquidity tightness and uncertainty over the government borrowing plan at a time when the Reserve Bank is expressing concern over inflation, Indian bond yields have shot up by a little more than 100 basis points in the past six months. As yields rise, bond prices fall and foreign investors would not like to remain invested in such a scenario.

Also, India's trade deficit is widening, which would lead to widening of the current account deficit. Investors are also pulling out from the equity markets; stock indices have fallen sharply on days.

According to an official with an FPI entity, India's debt market does not give much of an opportunity for investors. There is no space left to invest more and the incremental space that gets opened is too little.

Foreign investors bought about $23 billion in calendar 2017 but that support won't be available this year. So, the entire Rs 6-trillion borrowing programme will have to be borne by local investors. This would be difficult to manage, said the treasury head of a bank.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Mar 06 2018 | 9:51 PM IST