Launched in 1998, SBI Magnum Income Fund has been ranked CRISIL Fund Rank 1 in the long-term income category for the past four quarters till June. The fund has also been in the top 30 percentile of the CRISIL Mutual Fund Rankings (Fund Rank 1 or 2) for the past seven quarters.

The fund’s assets under management (AUM) have seen considerable growth during this period — from Rs 46 crore as of December 2011 to Rs 5,266 crore as of June 2013. In comparison, the category has grown by 11 times during this period. The fund is being managed by Dinesh Ahuja since January 2011.

Income funds benefit when interest rates fall as yields and prices / net asset value (NAV) move in opposite directions. Between November 2011 and May 2013, when interest rates fell, newer bonds were issued at lower coupon rates; thus, the demand for older bonds - with higher coupon rates - went up. Higher demand leads to increase in the price of long-term bonds and ultimately results in higher NAVs (returns) for long-term income funds.

Further, bonds with a longer maturity benefit more than those with a shorter maturity in a falling interest rate scenario. In contrast, when interest rates rise, the bond prices fall and fund NAVs get impacted adversely. In the past couple of months, the yields have hardened reducing the returns (fall in NAVs) from income funds. Hence, the direction of interest rates impacts the performance of the income category. The 10-year government securities (G-sec) yield is used as a benchmark to observe trends in interest rates.

Performance The fund has outperformed its benchmark (CRISIL Composite Bond Fund Index) and the category as represented by CRISIL - AMFI Income Fund Performance Index, across various time frames – six months (absolute), one year, two years and three years on an annualised basis. During the past three years ended August 30, the fund has delivered annualised return of 8.2 per cent, higher than that of the benchmark (5.9 per cent) and the category (6.9 per cent).

The fund has given superior returns for the risk taken compared to peers as measured by the Sharpe ratio (the higher the better). The fund’s Sharpe ratio was 1.66, against the category’s 1.44 over a three-year period ending August 30, 2013.

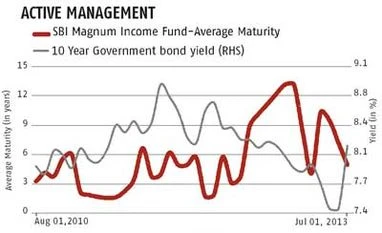

Duration management The fund has taken active duration calls based on debt market dynamics. For instance, amidst the current market scenario where the 10-year G-sec yield hardened from 7.44 per cent in May to 8.17 per cent in July, the average maturity of the fund decreased from 9.39 years to 4.85 years in the same period. The average maturity of the fund was 1.67 years in March 2012, when the 10-year G-Sec yield was 8.57 per cent. As yields fell to 7.91 per cent in January 2013, the fund increased its average maturity to 13.06 years.

Similarly, in early 2011, the Reserve Bank of India raised the repo rate on multiple occasions from 6.5 per cent to 7.25 per cent. Accordingly, the 10-year G-Sec yield went up sharply between February 2011 and May 2011 from 8.01 per cent to 8.41 per cent. The fund maintained a low average maturity of around 1.54 years during this period.

Portfolio analysis The fund has also changed its asset allocation based on the interest rate scenario. In August 2012, the fund increased its exposure to G-Secs to over 50 per cent. The average exposure to G-Secs until February 2013 was 69 per cent against the category’s average exposure of 40 per cent. Between November 2012 and January 2013, the fund held above 81 per cent, on an average, in G-Secs in anticipation of an interest rate cut by the RBI.

The fund has maintained a good credit portfolio with an average 82 per cent of the debt portfolio invested in a mix of sovereign (G-Sec) and highest rated papers, AAA/A1+ for a three-year period ending July 2013.

CRISIL Research

)

)