Sebi plans further checks on participatory notes

Board to discuss next week; move follows consultations with market players following SIT recommendations on black money

Sanjay JogSamie Modak Mumbai Capital markets regulator Securities and Exchange Board of India (Sebi) is mulling further checks and balances on participatory notes (P-notes), aimed at increasing transparency and prevent misuse of the investment route.

The proposals will be debated by the Sebi board on the coming Friday. Following recommendations last year by the Supreme Court-appointed Special Investigation Team on undisclosed money, Sebi had begun consultation with the issuers on tightening these norms.

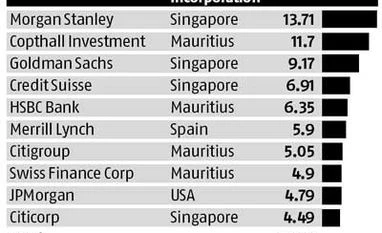

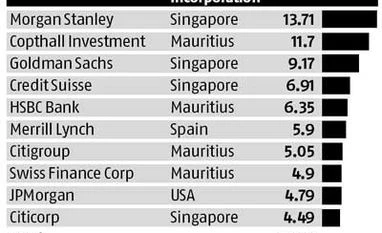

P-notes or Offshore Derivative Instruments allow foreign investors to take exposure to Indian stocks without registering with Sebi. These are issued by foreign portfolio investors (FPIs) registered with Sebi. Morgan Stanley, Goldman Sachs, JPMorgan and Credit Suisse are among the biggest P-note issuers on the Indian market.

According to sources, the regulator wants P-note issuers to conduct greater scrutiny of the subscriber entities. Sebi might ask them to put in place the same level of Know Your Customer checks for subscribers as for onshore investors, who have to meet the anti-money laundering rules.

Additionally, Sebi might impose restrictions on transfer of P-note among subscribers. It might also ask issuers to conduct a semi-annual check on the P-note holders and positions. The regulator wants strong systems in place to identify the end-beneficiaries. Information on the latter is needed to ensure an institutional investor doesn’t breach the 10 per cent investment cap in a single company.

Further, Sebi might prescribe better profiling of P-note subscribers to ensure if they are regulated in their home country. Issuers might also have to ensure that the threshold of 25 per cent for companies and 15 per cent on trusts and partnership firms isn’t breached.

In the past two years, Sebi has been tightening norms on P-note issuances to prevent round-tripping and flow of undisclosed money through this route.

“Sebi has plugged several loopholes. It remains to be seen how significant the new changes are. Major tinkering might further reduce flows from this route,” said an official at a P-note issuer, requesting anonymity.

At the peak in 2008, nearly 40 per cent of foreign flows into the country were through P-notes. Currently, these account for 10-12 per cent for foreign flows. Beside regulatory tightening, the new FPI regulations, which have made the registration and compliance process easier for foreign investors, have led to the dwindling of flows through the P-note route.

However, “P-notes remain an important access product. Several investors who don’t want to go through the pain of registering onshore and filing returns opt for this route. These investors might stop investing if rules are tightened,” said the official quoted above.

As of end-March, equity assets under custody (AUC) stood at Rs 2.23 lakh crore, nearly 12 per cent of the total FPI AUC of nearly Rs 19 lakh crore.

)

)