Sebi raises eyebrows as buybacks exceed equity issuances 2.3 times

So far this year, shares worth Rs 23,500 cr bought back in 20 deals vs Rs 10,000 cr raised via IPOs

)

Explore Business Standard

Associate Sponsors

Co-sponsor

So far this year, shares worth Rs 23,500 cr bought back in 20 deals vs Rs 10,000 cr raised via IPOs

)

Capital market regulator Securities and Exchange Board of India (Sebi) has expressed concerns over high amount of share buybacks relative to fresh capital raising in the domestic market. In the past two years, the quantum of share buybacks has far-exceeded the amount of new equity capital raised.

"Equity capital raising has been pretty impressive last year. But the amount which went back to investors was 1.5 times that raised. More money is being returned to investors against money raised," said Ajay Tyagi, chairman, Sebi.

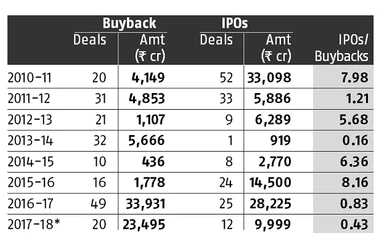

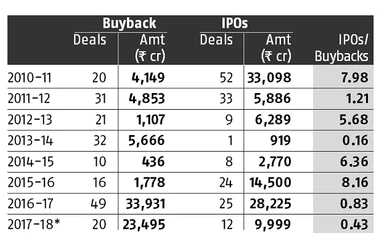

So far this fiscal, India Inc has extinguished shares worth nearly Rs 23,500 crore through 20 buybacks, 2.3 times more than the Rs 10,000 crore raised by way of initial public offerings, as per research firm Prime Database. Similarly, last fiscal companies repurchased shares worth Rs 33,931 crore through 49 buybacks, while 25 IPOs cumulatively had raised Rs 28,225 crore.

Shares bought under a buyback programme are extinguished by the company, technically reducing the equity float (shares available for trading) in the market. On the other hand, IPOs or other form of equity capital raising help add more float to the market.

Speaking at a capital market conference organised by industry body Ficci, Tyagi said, "This is possibly reflective of constraints in investment opportunities. Hopefully, the situation will improve with more IPOs lined up."

The Sebi chief said IPOs worth Rs 50,000 crore have been filed with Sebi and the current fiscal year could see record amount of IPO mobilisation. Interestingly, 2017-18 is also likely to be a record year for share buybacks. While buybacks worth Rs 23,500 crore have already been completed, more, including Infosys' Rs 13,000 crore repurchase programme, will be launched soon. This will see last fiscal's record buyback tally of Rs 33,931 crore getting topped.

In the last two years, buybacks have gained currency as a tool to reward shareholders after the government imposed an additional 10 per cent tax on dividends. Tyagi said strong IPO pipeline and the 25 per cent minimum public shareholding requirement for state-owned companies will help improve the floating stock in the market.

Tyagi also highlighted the increase in secondary share sale component in IPOs, which is a sign that the stock markets are "providing a viable exit to existing investors." The fresh fund raising is on the decline due to downturn in private sector investment cycle.

Other issues

Tyagi said the "twin balance sheet issue" is inhibiting private sector investment and the issue is being addressed by the government, Reserve Bank of India and Sebi.

The Sebi chief also appreciated the growth in the domestic mutual fund industry. "With assets of Rs 20 lakh crore, a fifth of the banking system, (MFs have become) the backbone for investments in capital market," he said.

Tyagi also touched upon the various committees set up by Sebi to improve the market integrity and governance standards.

"We are very serious about the issue of enhancing the participation of minority shareholders and protecting their rights. Also, the issue like independence of independent directors and their active participation in decision making at companies," said Tyagi adding that the corporate governance committee led by Uday Kotak, executive vice-chairman of Kotak Mahindra Bank, is deep-diving on all these issues.

Concerns over large foreign flows

Speaking at the same event, G. Mahalingam, whole-time member, warned of huge foreign inflows at a time when the rupee was showing "substantial amount of appreciation" against the dollar and increase of issuance in Masala bonds, rupee-denominated debt issued outside India.

"We need to be very careful as far as allowing foreign flows into the country. We can think of different ways of allowing these flows under a calibrated system," said Mahalingam, who was the executive director at RBI before joining Sebi.

Recently, Sebi had imposed restriction on further foreign investor participation in Masala bonds after their ownership neared the ceiling.

"Masala bonds don't hold any currency risks as far as the country is concerned. But at the same time the external liabilities of the country goes up. This is something we need to bear in mind," he said.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Sep 06 2017 | 11:54 PM IST