Sebi tightens P-note norms

New regime places more limits on unregulated foreign entities

Sachin P Mampatta Mumbai The Securities and Exchange Board of India (Sebi), tweaking the position it had taken in its earlier draft on Foreign Portfolio Investors (FPI), has tightened the rules for issue of participatory notes (P-notes).

The regulator had barred only Category-III FPIs from issuing P-notes in the draft guidelines that were part of its October board meeting agenda. However, the gazette notification, which has given the FPI framework an official status, also bars certain entities under Category-II from issuing P-notes.

Participatory notes, or offshore derivative instruments, are used by foreign investors wishing to invest in the Indian markets without registering with Sebi.

Kishore Joshi, senior associate (funds), Nishith Desai Associates, said the intent might have been to ensure the regulator had a certain degree of control over foreign investors - through a foreign regulator, if not directly.

"Considering that the Indian regulators (including Sebi) do not have direct jurisdiction over such foreign instruments, the intent of Sebi seems to be making foreign investors invest directly into India by registering as FPIs, instead of coming through the P-note route. Sebi has allowed only 'regulated' entities to issue/subscribe to P-notes, ensuring that such entities can be easily reached through foreign regulators," he said.

"The regulator is taking the position that P-notes should be issued only to entities that are regulated in their own right," said Naresh Makhijani, partner, KPMG.

The notification bars unregulated entities from using P-notes. "…Those unregulated broad-based funds that are classified as Category-II FPIs by virtue of their investment manager being appropriately regulated shall not issue, subscribe to or otherwise deal in offshore derivative instruments, directly or indirectly," it said.

This is in contrast with the restriction placed only on Category-III investors in the agenda paper issued after the Sebi board meeting.

"No Category-III FPI shall issue or subscribe to offshore derivative instruments directly or indirectly," the paper had said.

Under the new FPI regime, foreign investors are classified into three categories. In Category-I are government entities like institutions investing solely on behalf of a country's central bank. Category-II has regulated entities like mutual funds based out of foreign countries and supervised by other nations' regulatory agencies. And, those that do not fall in either of the first two categories are included in Category-III.

Tejesh Chitlangi, partner at IC Legal, said Sebi seemed to have taken note of feedback on the draft regulations.

"One criticism of the draft regulations was that it was going back to an earlier regime, of 2008, when P-notes' use was much less stringent. Back then, around 50 per cent of the inflows came through the P-note route. Sebi seems to have looked at addressing that issue. Earlier, unregulated entities could issue P-notes if their investment manager was regulated. That is no longer possible under the new regime, where regulations are even more stringent than the FII regime," he said.

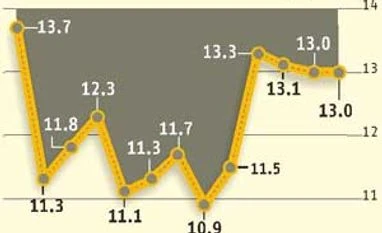

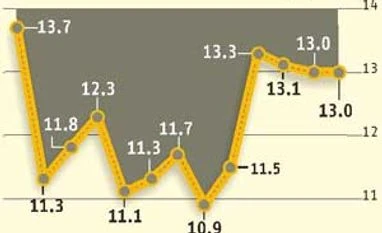

In November 2013, the notional value of P-notes on equity, debt and derivatives stood at Rs 1.82 lakh crore, or 13 per cent of assets under custody of foreign institutional investors.

)

)