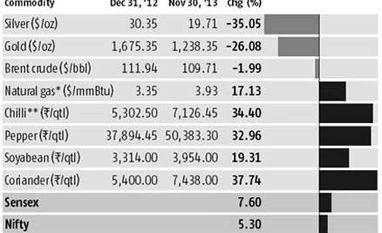

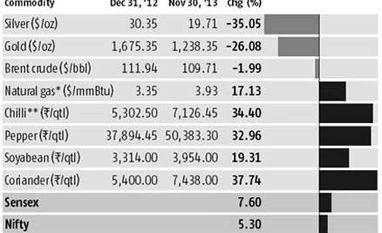

If you believe investing in metals such as gold and silver made you richer in 2013, think again. Digging deeper into the commodity basket and the price performance data reveal an interesting picture. In Indian context, among top gainers on the spot National Commodity and Derivatives Exchange (NCDEX), is coriander that saw its price moving up nearly 38 per cent (year-to-date, or YTD). Pepper prices gained nearly 33 per cent (YTD) on the back of short supply situation amid lower production estimates.

Among other agri commodities, chilli (Guntur) prices have been volatile with a positive bias (up 34 per cent YTD), as most farmers and traders were expecting the output to be in line with last year. However, the projection has been lowered, as only 70 per cent of the crop is now expected to hit the market due to crop damage.

However, Brent crude prices have slipped around two per cent YTD, while that of natural gas futures (HH) have gained 17 per YTD to $3.9/mmbtu as on November 29, data show. Gain in these commodities is far higher than the rise in Nifty (up 5.3 per cent YTD) and Sensex (up 7.6 per cent YTD).

Interestingly, gold and silver have lost nearly 26 per cent and 35 per cent (YTD) at the international level, data show. Base metals like copper, aluminium, lead and zinc have also not fared well on the London Metals Exchange (LME) thus far in 2013. Analysts suggest the commodity prices have also been impacted due to the US Federal Reserve’s plans to wind down the bond buying programme, demand from China and the rupee–dollar equation.

Gaurav Dua, head of research at Sharekhan, says, “US bond-buying taper has already been impacting the commodities space markets for quite some time. The impact is seen on bullions and industrial commodities as well.” Shriram Pitre, senior vice-president and head of commodity and currency research, says, “Commodities already seem to be factoring the likelihood of the US Fed beginning to scale back the size of its asset-purchase programme. Markets now seem to be anticipating the tapering to start in Q12014.” The key factor that would impact precious metals in India will be rupee’s movement against the US dollar. At the same time, commodities that are not internationally traded, domestic production and consumption would be the price determining factor, analysts say.

Anand Rathi’s Pitre is bearish on international gold and silver for 2014. However, if the rupee continues to weaken, he expects the downside in these precious metals to be limited. “We would not recommend buying gold and silver at current levels. For investing, a level of Rs 25,000-24,000 for gold and Rs 35,000-32,000 for silver would be more attractive instead,” he says.

On a short term basis, analysts expect Brent crude to trade down supported by the breakthrough in nuclear deal between Iran and other world powers. On the other hand, the outlook of Natural Gas looks positive, as prevailing climate conditions in the major consumer US is favouring the sentiments.

“Brent is likely to find support near $102. A direct fall below the same would be an early signal of renewed selling pressure which may test $88 per barrel later. In the MCX, prices are likely to test Rs 5,500 a barrel initially, followed by Rs 4,800 – 4,500 regions later. Gas prices, however, are most likely to edge higher (in MCX futures market) if prices consistently trade above Rs 220 towards a target of Rs 280/310 levels later,” says C P Krishnan, wholetime director, Geojit Comtrade.

Analysts at Sharekhan expect aluminium prices to head lower to $1,640 level in the near-term. However, in next nine-12 months, the metal is likely to rise to $2100 level on China's picking up momentum, sustainable and faster recovery in the US economy, tighter market amid production cuts by the smelters as the prices fall. Prices of the other base metals such as zinc (target: $2,400), lead (target: $2700) and copper (target: $8300) are also likely to trend higher over the next 12 months, they say.

As regards sugar, Krishnan of Geojit sees support for prices at Rs 2,600/2,200 levels (in the NCDEX futures market) and expects strong resistance at around Rs 3,800 levels. As regards the other agri-commodities, analysts expect prices of pepper to remain firm over the medium-term. Chilli prices, too, are expected to rise as stocks could get depleted due to heavy damage to the standing crops amid cyclonic storms in major producing states in India.

Prices of coriander that have surged over the year on expectations of lower production and a rise in exports are also likely to remain firm over the next few months, analysts say. Crop failures in Bulgaria and Romania, which are the other major producers are likely to support the prices.

With Ashok Jayavant Divase in Mumbai

)

)