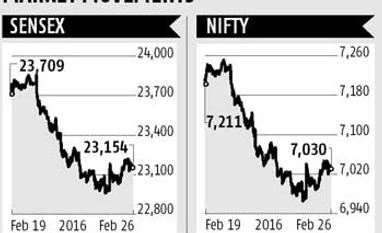

Sensex braces for worst monthly show in 4 years

The index gains nearly one per centThe index gains nearly 1% on positives in Economic Survey on positives in Economic Survey

BS Reporter Agencies Mumbai The benchmark Sensex is down nearly seven per cent this month and is set for its worst monthly showing in nearly four years. The 30-share bluechip index has dropped 1,700 points this month. The fall comes ahead of the Budget on February 29, where the Narendra Modi-led government will have to tackle the challenge of balancing growth expectations and maintaining fiscal deficit.

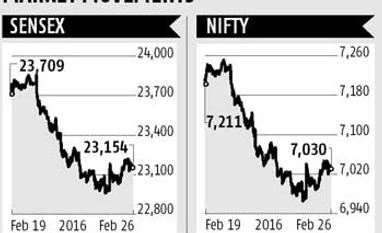

The markets on Friday recouped some losses after the Economic Survey had key positives such as calls for fiscal prudence and stable inflation. The Sensex gained 178.3 points, or 0.8 per cent, to end at 23,154.3. The 50-share Nifty added 59 points or 0.85 per cent, to close at 7,029.75.

The benchmark indices had gained as much as 1.2 per cent, but gave up some gains as traders remained cautious ahead of the Budget.

Experts said the markets would provide some leeway on fiscal deficits as long as the government undertook measures such as pruning subsidies.

Jayant Manglik, president, retail distribution, at Religare Securities, said, “Positive global cues gave the initial push, which was later supported by the Economy Survey report, wherein India’s GDP growth figure was revised upward. However, the upside remained capped as participants preferred to lighten up their positions ahead of the Union Budget.”

Of the 50 stocks in the Nifty, 37 closed in the green. Coal India, Hindalco, State Bank of India, Vedanta and Cairn India gained the most, their counters up between 2.9 per cent and 4.2 per cent. On the other hand, Hero MotoCorp, Bajaj Auto, Lupin and Bharti Airtel lost between 1.4 per cent and 3.5 per cent during Friday’s trade.

Among the sectoral indices, banking, realty and capital goods gained the most with a rise of between 1.1 per cent and 1.6 per cent. Performance of the mid-cap and small-cap indices was muted. The BSE MidCap index was up 0.3 per cent, while the SmallCap index turned into red with a loss of 0.45 per cent.

Anand James, co-head (technical research desk) at Geojit BNP Paribas Financial Services, said, “The latter half of the day was, however, energised by the release of the Economic Survey, which was also in favour of meeting the 3.5 per cent fiscal-deficit target. While banks raced faster than the broader market on proposals for budgetary allocation of Rs 700 billion (Rs 70,000 crore), the possibility of commitment towards fiscal consolidation raised expectations of further central bank easing.”

The Sensex is valued at 14.4 times its estimated 12-month earnings, versus a multiple of 10.9 for the MSCI Emerging Markets Index.

Foreign investors sold shares worth nearly Rs 700 crore on Friday, provisional data showed.

)

)