Equities continue to scale new peaks, defying warnings by many market pundits of a possible consolidation. The S&P BSE Sensex on Wednesday gained 315 points, or 1.05 per cent, to close at 30,248, and the Nifty breached 9,400 for the first time to close at 9,407.3,

90.4 points, or 1 per cent, higher than its previous closing. The broader markets witnessed a similar trend with the mid- and small-cap indices rallying 0.87 per cent and 0.75 per cent, respectively.

Since the Sensex touched 30,000 intra-day on April 5, many experts have been warning that a market correction, or at least a consolidation (time correction), could be underway.

The current rally has been driven by aggressive buying by mutual funds and insurance companies. Since April 1, domestic institutions have purchased equities worth Rs 11,575 crore while foreign portfolio investors (FPIs) trimmed their exposure to the Indian market by nearly Rs 4,000 crore.

“The benchmark indices today touched new lifetime highs as the market continues to cheer a favourable set of developments such as a normal monsoon, benign crude oil prices and a decent set of fourth-quarter earnings,” said Pankaj Pandey, head of research at ICICI Direct.

Experts said liquidity in the market would continue to be high in the medium term on the inflows that various mutual fund schemes were receiving.

With expectations of a good monsoon, the focus of the market would shift towards corporate earnings, they added.

“Although earnings during the last quarter of 2016-17 were not very positive, they were certainly better than street expectations. Going forward, while consumption-related sectors will see traction, sectors like information technology and banking could see a downturn,” said Sunil Shah, head of research at Axis Securities.

Pandey sounded more optimistic. “Earnings growth will be the key factor driving the market. With a stabilised commodity base, upbeat consumption and on a lower base, earnings could witness a double-digit growth recovery in 2017-18,” he said.

Global conditions are another reason for the current rally. The victory of Emmanuel Macron in the presidential elections has allayed fears of a possible Brexit in France. The Trump administration in the US has not taken any major adverse steps yet. And, the pace at which US Federal Reserve raises interest rates along with developments in the euro zone will play a role in deciding the direction of global markets.

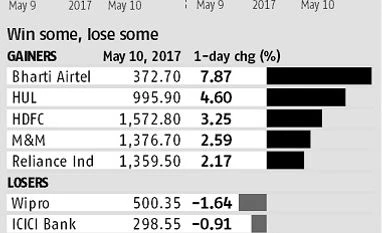

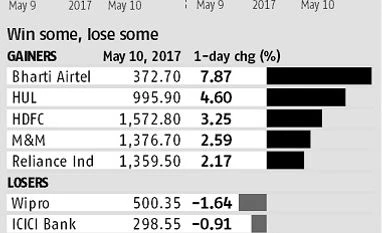

Wednesday’s rally was spurred by the official forecast that rainfall during the ensuing monsoon would be 96 per cent of the long-term average. Bharti Airtel, whose shares soared 7.8 per cent, was the best performer in the Sensex. Hindustan Lever and HDFC rallied 4.6 per cent and 3.25 per cent, respectively, as did Reliance Industries (2.2 per cent).

“The bullish monsoon forecast added legs to the ongoing rally. Earnings positivity has been keeping the market buoyant and prospects of FPIs turning buyers in equities have pushed the market higher. Financial services stocks were seen rallying, reflecting market expectations of further strength in equities,” said Anand James, chief market strategist, Geojit Financial Services.

)

)