The Sensex gained over 300 points for a second straight session on Monday amid positive global cues and value buying by domestic investors.

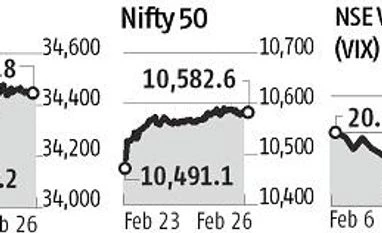

The benchmark index gained 303 points, up 0.9 per cent, to close at 34,445, while the broader Niftly closed at 10,582, up 91.5 points or 0.87 per cent. The broader markets followed a similar trend with the BSE mid- and small-cap indices gaining 0.74 per cent and 0.88 per cent, respectively.

According to provisional data, foreign portfolio investors (FPIs) sold equities worth Rs 11.2 billion, while domestic institutions purchased shares worth Rs 14 billion.

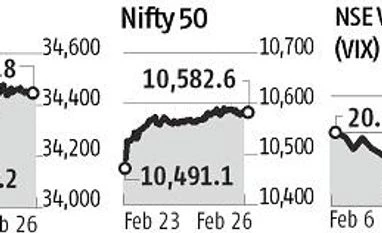

Market participants said the sharp rebound during the last two sessions could help soothe investors’ nerves rattled by a sharp fall in markets since February 1. In the last two sessions, the Sensex has gained 625 points. More importantly, market volatility is easing after a turbulent start in February. India VIX, a gauge of market volatility, fell 3.57 per cent on Monday to 13.69, the lowest since January 8. The volatility index touched a peak of 20 on February 20 and has now fallen 32 per cent.

Analysts said the market could stabilise at the current level amid strong global cues. All major global markets have gained in the last week. In Asia, investor sentiment seems stronger, with China, Taiwan and Hong Kong witnessing rallies of over 5 per cent last week. The US Federal Reserve’s economic projections also boosted investor sentiment. Domestic cues seem to be improving after a Rs 114 billion banking fraud dampened the investor sentiment.

Analysts expect strong macroeconomic data for the December quarter, which will be released on Wednesday.

“Relief from speculations over the Fed rate hike led to a sharp rally across global markets, triggering positive moves in domestic indices as well. Benchmark bond yields have dropped and the focus has shifted to equities as the tax overhaul in the US is expected to deliver more fiscal stimulus to the economy. An appreciating rupee also boosted sentiments at home,” said Anand James, chief market strategist, Geojit Financial Services.

Automobile stocks led Monday’s rally, with Maruti Suzuki and Tata Motors gaining 3.4 per cent and 3.2 per cent, respectively.

IndusInd Bank and Axis Bank shares gained 2.9 per cent each. On the other hand, tighter US visa regulations triggered a sell-off in technology stocks, with TCS and Infosys falling 1.3 per cent each. Sun Pharma was the biggest loser in the Sensex, with a decline of 2.5 per cent.

The Sensex has shed 4.2 per cent in February so far. This could be the worst month for the index since November 2016 when it lost 4.57 per cent.

Data showed, FPIs sold shares worth $1.5 billion in February — the highest in six months — but on a year-to-date basis, they were still net buyers at $547 million.

)

)