Small savings schemes still attractive despite cut in rates. Here's why

Investors can also look at 8% Indian govt bonds if they have a long investment horizon

Tinesh Bhasin Mumbai The government has reduced interest rates on small savings schemes by 10 basis points across the board for the July to September quarter. For those in the 10 per cent and 20 per cent tax bracket, small savings schemes remain attractive despite the downward revision. To beat inflation, investors in the highest tax bracket should look at debt mutual funds.

“If you consider inflation at 4.5-5 per cent, small savings schemes work out to be better than bank fixed deposits. Company deposits with track record can offer 1-1.5 per cent higher rates but they are riskier,” says Manoj Nagpal, chief executive officer (CEO), Outlook Asia Capital.

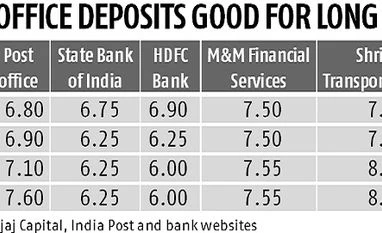

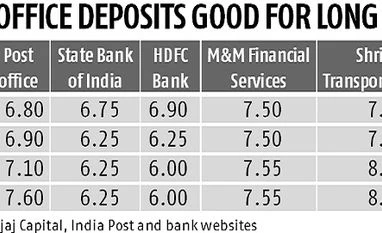

Interest rates on long-term post office fixed deposits (FDs) beat most banks’ FD rates. They offer 7.1 per cent return on three-year and 7.6 per cent on five-year FDs. For the same period, interest rates on State Bank of India’s FD is 6.25 per cent and on HDFC Bank’s is 6 per cent.

If investors are willing to lock in their money for a longer duration, there’s also the Government of India (GoI) 8 per cent bond with a maturity of six years. “These are available on tap at any nationalised bank and come with a sovereign guarantee,” says Mohit Mittal, head–fixed income, Bajaj Capital.

But if an individual in the highest (30 per cent) tax bracket invests in these, returns after tax are close to the inflation rate. Investment managers, therefore, suggest that debt mutual funds are the only option for them. Conservative investors should look at funds that hold papers until maturity — also known as accrual funds. Many short-term debt funds and income funds follow this strategy. “Opt for those funds which have returns between 8-9 per cent. Many have double-digit returns but those schemes also take higher risks,” says Malhar Majumder, a certified financial planner.

Accrual funds offering double-digit returns are usually invested in papers with lower ratings. “These funds do take collateral from the issuers to protect investors in case of a default. Retail investors, however, should still avoid them,” says Majumder. Mittal of Bajaj Capital suggests that to diversify risk, investors should invest in a mix of debt funds and GoI papers.

The reduction in interest rate of the Public Provident Fund (PPF) is the biggest blow for investors. If you save Rs 1 lakh every year at 7.9 per cent, you will end up with Rs 32.06 lakh after 15 years. A 10-basis-point lower interest rate will result in a final corpus that is around Rs 30,200 lower over this period. Since the government has been lowering the PPF rate consistently along with that of other small-savings schemes, the impact could be bigger over the long term.

Investment managers, however, say that individuals should continue with their PPF investments. This retirement product is subject to exempt-exempt-exempt (EEE) tax norm: There’s no tax at the time of investing, on accrual, and also at the time of withdrawal. The National Pension System (NPS) is an alternative that has the potential to fetch better returns over the long term, but it is market-linked and its final corpus is taxed at the time of withdrawal. At the time of maturity, 60 per cent of the corpus can be withdrawn in a lump sum. But only 40 per cent of this is tax-free. The balance 40 per cent has to be compulsorily invested in buying a life-long annuity plan from an insurer, returns from which are also taxable.

Interest rates on Sukanya Samriddhi Scheme and Senior Citizens' Savings Scheme are still attractive. Those eligible to invest in them should continue with these schemes.

)

)