Sugar mill byproducts to attract more investment

The sentiment has changed due to partial decontrol in sugar sales, high ethanol prices

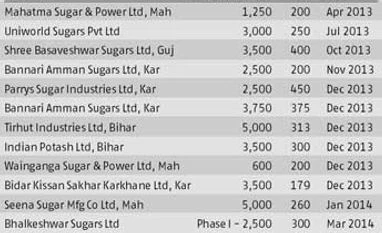

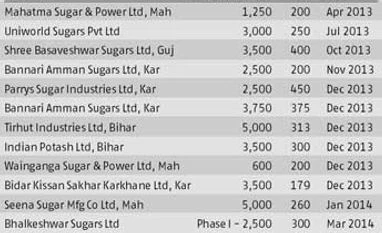

Dilip Kumar Jha Mumbai Neglected so far, the allied activities of sugarcane crushing are set to gain a major share of fresh investments due to the immense potential opened by the partial decontrol in sugar sales and 30 per cent increase in ethanol prices. Sugar mills, it is estimated, would be planning around Rs 4,000 crore of fresh investment to add 79,000 tonnes of fresh cane crushing capacity, for which commercial production is scheduled to commence by the end of 2014.

"With the partial decontrol of sugar sales and an upward revision in ethanol prices, along with the commitment on full procurement of the green fuel for mandatory blending with petrol by the oil marketing companies (OMCs), the sentiment has completely changed. Fresh investment will come largely in byproducts, including ethanol and electricity generation," said Narendra Murkumbi, managing director of Shree Renuka Sugars.

The Cabinet Committee on Economic Affairs (CCEA) partially accepted the Rangarajan committee report on decontrol of the sugar industry early this month. It decided to remove the levy obligation to supply the mandatory 10 per cent of output to the government at subsidised prices. The CCEA also withdrew the regulated release mechanism on sale of non-levy sugar in the market. Other important recommendations of the committee, such as decontrol of the sugarcane command area, minimum distance criterion and pricing have been left to the state governments.

Also, OMCs have started issuing letters of intent (LoIs) to the lowest bidders at a base price of Rs 34-36 a litre, around 30 per cent higher than the Rs 27 a litre until last year. Ethanol supply at Rs 27 was uneconomical for mills. "Now, we are able to find a market for the surplus molasses, which mills were selling at throwaway prices. The sugar industry will attract lots of investment in byproducts and earn more returns. Consequently, mills will be in a better position to pay farmers' arrears in time," said Abinash Verma, director general of the Indian Sugar Mills' Association.

Mills were selling surplus molasses as fodder or just burning it to avoid transportation cost on its supply to neighbouring mills.

Chaitanya Raut, an analyst with CARE Ratings, said, "While core activities will not be affected, allied business will drive sugar mills' business."

)

)