Weekly: Markets retreat from record highs on growth concerns

Capital Goods, banking and metal names among the top gainers

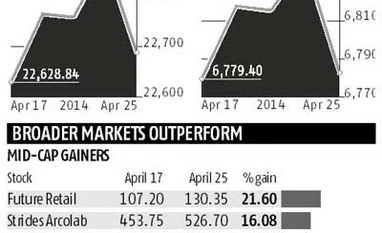

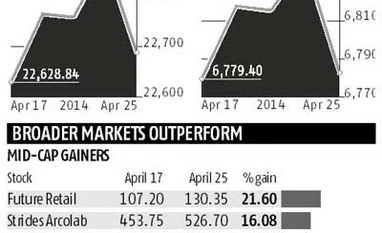

Jinsy Mathew Mumbai The benchmark indices settled with marginal gains for the week ended April 26, with the Sensex rising 0.26 per cent to 22,689 and the Nifty up 0.04 per cent at 6,783. However, the broader markets ended firm, with the small-cap index up one per cent and the mid-cap index recording a 0.5 per cent gain.

During the week, the benchmark indices hit record closing highs, but retreated on Friday due to concerns on growth. A Reuters poll showed that chances of a strong economic rebound were dim, irrespective of the outcome of the Lok Sabha elections, as industry remained weak.

El Niño, the disruptive weather phenomenon, could shave as much as 75 basis points off the country’s economic output, as a hit on agriculture could cause the central bank to delay cutting interest rates; inflationary pressures could lead to the Reserve Bank of India keeping interest rates high, affecting economic growth, according to ‘El Niño: Met sees sub-normal rains’, report by Bank of America Merrill Lynch.

Sectors and stocks The capital goods index rose four per cent, while the banking, metal, public sector undertaking and the health care indices gained one-two per cent. Markets participants continued to be averse to defensive pockets such as information technology and fast-moving consumer goods, with these indices falling 1.3 per cent and 2.5 per cent, respectively.

The oil and gas, realty and power indices lost one per cent.

Of the Sensex 30 stocks, only 16 closed with gains.

Mahindra & Mahindra was the top gainer, rising 7.3 per cent, after Credit Suisse upgraded its rating from ‘neutral’ to ‘outperform’.

Larsen & Toubro (L&T) and Bhel gained five-six per cent. L&T rose after the company won a Rs 4,510-crore order from Qatar Railways Company to design and construct the gold line of the Doha Metro project.

In the financial services segment, Axis Bank, State bank of India, HDFC, HDFC Bank and ICICI Bank gained 0.6-4.8 per cent. ICICI Bank, HDFC Bank and Axis recorded resilient growth in the March quarter. While Axis Bank’s profits were ahead of estimates, those of ICICI Bank and HDFC Bank were in line with expectations.

In the metals space, Coal India, Tata Steel, Hindalco and Sesa Sterlite rose 0.3-3 per cent.

Oil and gas majors ONGC and Reliance Industries closed in the red, down 0.3 per cent and 1.2 per cent, respectively.

All the frontline names in the information technology space saw losses, with Infosys, Tata Consultancy Services and Wipro ending 0.5-11 per cent lower. Wipro saw the steepest fall, shedding 11 per cent, after the company’s revenue guidance for the June quarter of FY15 was seen below estimates by analysts. Selling pressure continued to weigh down ITC and HUL, which lost three-four per cent.

)

)