The worst-performing stocks in India last year are about to make a comeback in 2016.

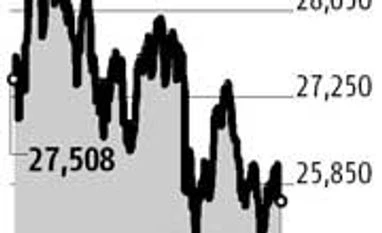

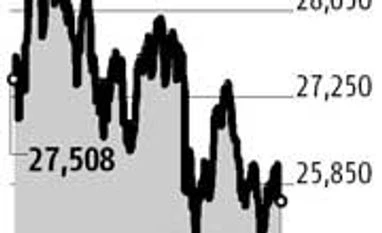

So, say Ashburton Investments and Birla Sunlife Asset Management Co, who favour large-cap shares over smaller peers due to attractive valuations and expectations foreign inflows will pick up. The S&P BSE Sensex of the nation's biggest companies fell five per cent in 2015, compared with gains of at least six per cent for gauges of mid and small-cap shares.

"Looking at relative valuations, the large-cap space is where we are focused on," said Jonathan Schiessl, UK-based head of equities at Ashburton, which oversees $12 billion. "Large-cap stocks have borne the brunt of emerging-markets related selling by foreign investors." In June, Schiessl said he favoured Indian equities over China stocks. The Shanghai Composite Index has since plunged 33 per cent versus the 5.8 per cent drop in the Sensex.

The Sensex trades at 20 times reported earnings, the cheapest in three years relative to the S&P BSE MidCap Index, which is valued at 26 times. The S&P BSE small-cap gauge has a multiple of 59. Overseas investors were net sellers of Indian equities in the second half of last year, as Prime Minister Narendra Modi struggled to push much-needed reforms through parliament and the prospect of higher borrowing costs in the US spurred a shift toward American assets from developing nations.

Bharat Heavy Electricals Ltd was the biggest decliner among the 30 Sensex stocks in 2015 amid sluggish order inflows for power equipment. Tumbling commodity prices weighed on materials producers including Tata Steel Ltd and Oil & Natural Gas Corp, while State Bank of India and ICICI Bank Ltd slumped more than 25 per cent amid concern about the banking sector's exposure to loans given to metal makers.

Sentiment toward emerging-market assets turned more bearish last year as a slowdown in China fueled the biggest retreat in raw materials prices since 2008 only, as the Federal Reserve ended its zero interest-rate policy. The MSCI Emerging Markets Index retreated 17 per cent in 2015, as global funds pulled a total $10.8 billion from South Korea, Thailand, Indonesia and the Philippines.

Foreigners return "With the Fed rate liftoff out of the way, overseas investors will return to India because of better growth prospects relative to other emerging markets," Sampath Reddy, chief investment officer at Bajaj Allianz Life Insurance Co, which has $6.6 billion in assets, said by phone from Pune, near Mumbai. "The wide valuation gap between the large and mid-caps won't last for long."

There are signs foreign funds are already coming back. India lured the only overseas inflows among eight Asian markets tracked by Bloomberg in December. The country's economy is forecast by the government to expand seven per cent to 7.5 per cent in the year through March, among the fastest in the world.

Mid-cap stocks may still outperform this year as domestic investors look for companies whose earnings are tied to the local economy, according to Vinay Paharia, a fund manager at Religare Invesco Mutual Fund.

Mutual funds bought $10.2 billion of shares last year, the most since 2008, spurring gains in companies that build roads, offer financial services and operate movie theaters and television channels.

"There is a wide bouquet of stocks to choose from and hence the potential to generate alpha is much higher for a midcap fund," said Mumbai-based Paharia, whose Religare Mid & Small Cap Fund has returned 30 per cent annually over the past five years through 2015.

Fading enthusiasm for Modi may also deter foreign investors from returning in significant numbers.

)

)