Bharti Airtel: India metrics shine, Africa under stress

India business drives margin expansion as minutes and subscribers grow in Q4

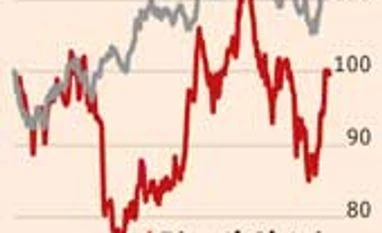

Malini Bhupta Mumbai Bharti Airtel's headline numbers in the fourth quarter (Q4) of FY13 are disappointing. However, with pricing power returning to the sector, operating metrics are improving. Both minutes and subscribers have increased on Bharti's India network during Q4. So, even as consolidated net profit is down 49 per cent, year-on-year, to Rs 508 crore in Q4, operating margins have expanded 117 basis points (bps) to 31.7 per cent, sequentially. Subscriber churn is also down. And, operating margins in India are up 200 bps quarter-on-quarter.

After consecutive quarters of contractions in new subscriber additions, the company has increased its subscribers. Both traffic on the network and minutes of usage per subscriber have gone up during the quarter as competitive intensity has abated, with several operators discontinuing services. The number of minutes consumed per subscriber is up from 435 a month in Q3 to 455 in Q4. The total number of minutes on the network increased five per cent, sequentially, to 253 billion. Data as a percentage of mobile revenue has grown to 6.5 per cent, compared to 5.7 per cent in the third quarter of FY13, says Emkay Global.

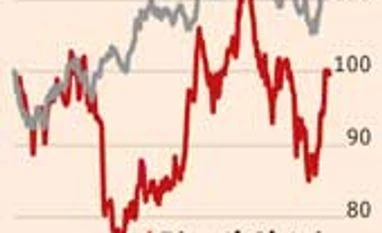

Although pricing power is returning to the sector, Bharti maintains the competitive intensity is still very strong. Revenues per minute continue to decline. Average revenue per minute, a key measure of profitability, has declined 0.5 per cent to 42.3 paise per minute, sequentially. The company's value-added services as a percentage of revenues remained flat at 17.4 per cent. Analysts expect this to change. Ankita Somani of Angel Broking expects tariff to inch up in India but Africa may continue to be a drag on blended margins. Analysts worry about the company's elevated costs and losses from Africa. Despite the improvement in India, the slowing growth in Africa is a cause of concern, as revenues are down 1.1 per cent, sequentially, at $1.12 billion. Minutes of usage per subscriber declined 15 per cent to 123 minutes, sequentially, and traffic on network declined 11 per cent. Operating margins declined from 27.1 per cent in the third quarter of FY13 to 25.4 per cent in Q4.

While the company's management believes it's economic slowdown and seasonality that has impacted the firm, analysts feel things seem to be improving for the company, as its largest competitor in Nigeria has been asked by the regulator to lower tariffs. A level-playing field in one of Africa's largest markets would impact Bharti positively, according to Nitin Padmanabhan of Espirito Santo Investment Bank.

)

)