E-com IPOs: Infibeam sets the ball rolling

Measured growth and expansion could help the firm turn profitable this year

Ram Prasad Sahu Mumbai The successful listing of Infibeam, India’s first pure-play e-commerce firm, to tap the primary market for Rs 450 crore will open the door for other companies in the sector.

Assuming a 25 per cent equity dilution in Initial public offering (IPO), Infibeam’s valuation is pegged at Rs 1,800 crore ($283 million). Its larger peer and market leader, Flipkart is valued at $12 billion, while the world’s largest listed e-tailer Amazon has a market cap of $202 billion. Infibeam runs an online retail store and an online marketplace for merchants.

Both Flipkart and Snapdeal have been raising money aggressively and have netted a significant part of the $6-billion coming into the sector over the past two years. Unlike its peers, Infibeam has been circumspect about fundraising and has kept its balance sheet size small. Debt (including short-term) is Rs 9.2 crore, with debt-to-equity at 0.04 times.

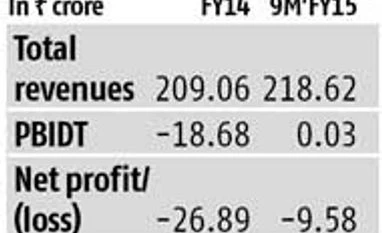

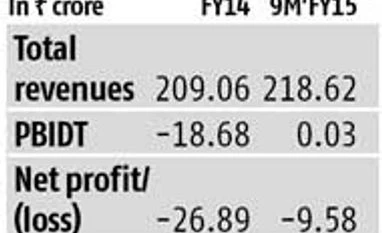

Infibeam’s annualised revenues for FY15 are pegged at Rs 290 crore, 39 per cent higher than Rs 208 crore in FY14. While losses have reduced from Rs 26 crore in FY14 to Rs 9.6 crore in the first nine months of FY15, it is just about at breakeven at the operational level from a loss of Rs 19 crore in FY14. User base has increased 33 per cent annually from three million in 2012 to about 7.2 million as of March, compared to Flipkart’s estimated registered users of 30 million and Amazon’s over 245 million.

ALSO READ: Infibeam files DRHP to Sebi for Rs 450-cr IPO Given the profitability trend, the enterprise value to gross merchandise value (GMV) metric could be a good way to value Infibeam. Globally, this metric throws up valuations varying from 0.2 times (Alibaba) to 0.9 times (Amazon). For Flipkart, the GMV is at $4 billion, which brings the EV/GMV to three, more than the international peers. At EV and estimated GMV for Infibeam at Rs 2,000 crore, valuations are at 0.9. Though it is lower than Flipkart, there is a difference in scale. On a m-cap to per user basis, there is a substantial gap of 10-20 times between listed global and Indian companies. Analysts say this indicates there is potential for re-rating.

A large part of the appeal of ecommerce companies lies in growth expectations. Though travel is the largest component of India’s e-commerce market, accounting for 70 per cent and e-tailing is the second largest (16 per cent). The E-tailing market ($600 million in 2012) is expected to reach $7 billion in CY15 and $44 billion in CY20. While e-tailing will still be a small part of the overall retail segment at four per cent in 2020, its share will grow from 13 per cent (CY2015) to nearly half of the organised retail market.

Analysts say like their international peers who turned profitable, given the potential Indian companies, too, could make money over the next couple of years. The only deal-breaker is the level of discount which is not limited to festival period but is all year around. This means the successful will be those who survive.

)

)