JSPL may find it tough to complete projects

Project cost and return ratios may get hit if clearances don't come on time

Malini Bhupta Mumbai Investors tend to mercilessly pummel stocks even if there is a whiff of some regulatory action against the company or its promoter. Shares of Jindal Steel and Power Ltd (JSPL) have been facing a similar crisis of confidence over the last couple of years. In the past, shares of IRB and India Cements, have been beaten down as news of some regulatory risk surfaced against the promoters of these companies.

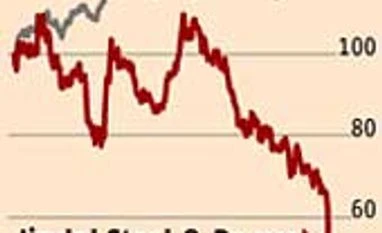

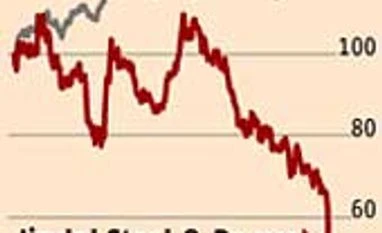

Shares of JSPL fell 15 per cent on Monday on news that the Central Bureau of Investigation had registered fresh cases against its chairman, Naveen Jindal, over irregularities in allocation of coal blocks. However, the Street has not woken up to the risk now.

Over the last two years, shares of JSPL have fallen 64 per cent even as benchmark indices have risen in this period.

The risks that the company faces are not small as the company is the biggest benefactor of coal assets among private sector players. JSPL and its subsidiary Jindal Power have been allotted nine coal blocks in all since 2006. Of these, five coal blocks have been allocated to JSPL. What bothers investors is that these blocks have found a mention in the Comptroller and Auditor General's report. Analysts say the risk of regulatory action is high as the company has been allocated the largest coal reserves (2,587 million tonnes). As of now, there is a demand from several sections for cancellations of all the blocks.

As a result of this regulatory overhang, some analysts have suspended their ratings on the stock, as many assumptions on the company's performance could change. For starters, clearances and approvals for projects may now be affected. The other concern that the market has is the possibility of a cap on profitability from captive coal power projects. Both these are risks the market is worried about. In case projects get delayed due to clearances, its debt might increase. Currently, 40 per cent of the capital employed is for unfinished projects. Despite these overhangs, analysts believe some buying may happen if the stock price goes below book value.

According to Deutsche Bank Markets Research, a one-year delay in steel and power plants under construction can result in FY15 estimates going down 19 per cent. "Until the investigation is concluded, the stock may be volatile and trade at a discount to price/book (allowing for a safety factor for potential liabilities), rather than at a sum of total parts," the brokerage says.

)

)