Labour pains for Bajaj Auto

A wage hike as demanded by unions could hit operating margins at a time when sales volumes are shrinking

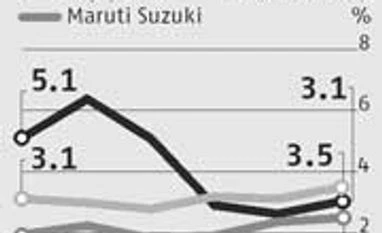

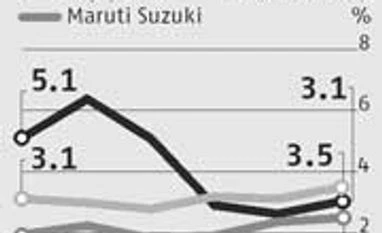

Krishna Kant Mumbai Bajaj Auto might be forced to forgo some of its operating margins if it accepts the demand of the striking union at its Chakan plant in Pune. In the last few years, the company gained from a steady improvement in labour productivity at its factories, helping it to maintain industry, leading operating margins, despite a steady increase in raw material costs. Employee cost as a proportion of net sales declined to 3.1 per cent in FY13 from 5.1 per cent in FY10. The corresponding ratio for Hero MotoCorp was 3.5 per cent and 5.8 per cent for TVS Motor Company in FY13.

Bajaj Auto's raw material intensity during the period increased to 71.9 per cent from 70.6 per cent of net sales in FY10. A tight check on labour cost and other overheads not only helped it shield profitability from high commodity prices, but actually improve it. Operating margin (excluding other income) improved to 18.2 per cent of net sales in the last financial year from 17.3 per cent during the financial year ended March 2010.

Now, there is a risk of this equation getting disturbed. "There is always a possibility of a rise in wage cost after a protracted labour strike. Bajaj Auto's wage cost as a proportion of net sales could rise by 40-50 basis points," say auto analysts at a leading brokerage house. The extra wage cost will surely pinch, given the negative volume growth in the current financial year.

The union is demanding a 25 per cent increase in wages, regularisation of temporary and contract workers, better work conditions and stock options. This is much higher than the historical growth in Bajaj's wage bill. In the last five years, the company's employee cost grew at a compounded annual rate (CAGR) of 6.7 per cent. Net sales during the period expanded at a CAGR of 18.2 per cent, helping Bajaj cut its per-unit wage cost and thus juice up its margins. Some, however, downplay the actual impact of a wage hike, as employee cost is one of many factors that impact profitability.

Historically, labour strikes have always resulted in an increase in wage cost for companies. Maruti Suzuki's employee cost increased to 2.5 per cent of net sales in FY13 from 1.9 per cent in FY10. Hero's salary and wages now account for 3.5 per cent of net sales against 2.8 per cent three years ago. Both the companies witnessed labour trouble in recent years.

)

)