Market expects sharp rate cuts as demand collapses

Core inflation stays below 4%; India Inc loses pricing power

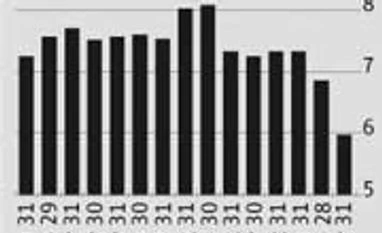

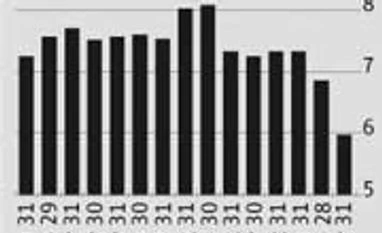

Malini Bhupta Mumbai The market is expecting the central bank to cut rates aggresively, as inflation is meaningfully down on weak demand. The inflation print for March has fallen to a 40-month low of 5.96 per cent, as prices have moderated both year-on-year (y-o-y) and month-on-month (m-o-m) basis. The wholesale price index print for March is well below consensus estimates of 6.3 per cent as core, primary and manufacturing inflation have all cooled. Interestingly, for three straight months, core (non-food manufactured) inflation stayed below four per cent.

Core inflation has fallen for the seventh straight month to a three-year low of 3.41 per cent y-o-y. The Reserve Bank of India (RBI) tracks this rate very closely and with demand collapsing over the last few months, it is widely believed that RBI will have to cut rates faster to support growth. Shubhada Rao, chief economist at YES Bank says March inflation is 84 basis points lower than RBI's projection of 6.8 per cent.

Most economists believe RBI will have little reason to accelerate the rate cycle, as demand for industrial and consumer products has come under severe pressure. Corporate India has lost its pricing power as demand has collapsed. The combination of lower commodity prices and dilution of pricing power caused by the negative output gap is likely to keep a check on price pressures in the economy, explains Rao. When RBI had started tightening the rate cycle in 2011, it had argued that companies continued to enjoy pricing power on strong demand, despite rate hikes.

This argument is no longer valid, demand has collapsed and companies have lost pricing power. Though power and raw material costs have risen, producers are unable to pass these on to the consumers. According to Kaushik Das of Deutsche Bank, with core inflation below four per cent and growth momentum anemic, RBI would support an easing monetary policy bias in the next few months. Consequently, he expects RBI to cut the repo rate by clips of 25 basis points (bps) in the next two policy meetings (May and June). While most are factoring in a rate cut of 25 bps, there are others who are expecting 50-75 bps cut.

RBI may find it difficult to justify a pause in rate action as not only is core inflation down, but fuel and power prices have also slid marginally on m-o-m basis. Besides, the inflation in primary articles has dropped 210 bps m-o-m to 7.6 per cent. The consumer price index too, has fallen marginally in March.

)

)