More headwinds ahead for Bajaj Finance

But experts believe any further stock fall provides good entry for long-term investors

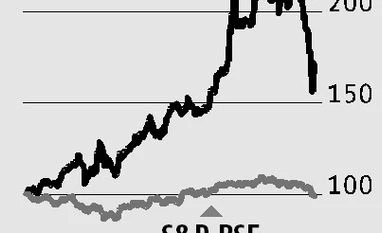

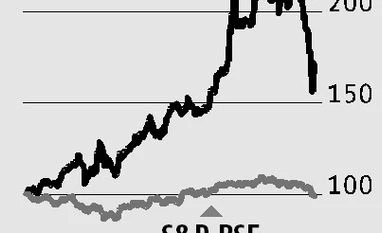

Hamsini Karthik Mumbai None of the non-banking finance companies (NBFCs) stocks was spared ever since the government decided to pull back old banknotes of Rs 500 and Rs 1,000. The stock of Bajaj Finance, the most sought-after consumption play, has ceded over 12% of its market value since its stock price close of November 8. This is despite the relief rally of 10% on Wednesday.

Bajaj Finance, the lender, spans across consumer durables, two-wheelers, personal loans, small and medium enterprises, and rural areas. "So, if NBFC stocks are falling due to note ban, the stock of Bajaj Finance will also slide," says Rajiv Mehta of IIFL. Worse, analysts aren't able to make out the extent of the problem. So, as long as uncertainties persist, Bajaj Finance will remain as vulnerable as other NBFCs, and investors may be staring at weak December quarter results from the lender.

Results may look poor quarter over quarter as well as year over year due to high bases of both periods. Also, Bajaj Finance, which has historically seen very low share of non-performing assets (NPAs or bad loans), could see the trend shifting in December quarter. "Most EMI (equated monthly instalments) payments are through cash, hence, the collection cycle could be impacted. Therefore, whether we look at loan-loss provisions from a 90-day basis or 120-day basis in December quarter, these will be high for Bajaj Finance, as is the case with most NBFCs," an analyst from a domestic brokerage said.

Further, reports suggest there could a steep pullback in purchases, particularly of two-wheelers, three-wheelers, and consumer durables, due to cash crunch from note ban. Bajaj Finance also has a significant exposure to loans against property, a segment that could come under pressure from note pullback. Segments mentioned above account for 40% of total loans made by Bajaj Finance, therefore making of new loans may come under pressure, and the lender could see rising NPAs. For these reasons, analysts expect risk for Bajaj Finance's stock in the near term.

However, given the lender's leadership in consumer lending, strong business model, growth potential, and now, lower valuations than peers, the stock could be among the first to rebound. Hence, analysts are suggesting potential long-term investors to buy the stock on its further fall.

Mehta says that at current stock valuations (3.5-4 times the lender's FY18 book value), Bajaj Finance looks attractive. After note ban, two of three analysts polled on Bloomberg recommended 'buy' on the stock. Broadly, analysts are setting a target price of Rs1,000-1,090 for the stock.

)

)