NMDC: Weak ore price remains a challenge

Muted iron ore demand has pushed the company to cut prices regularly to half the levels seen in January

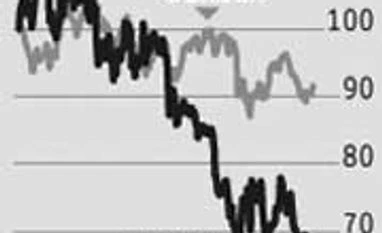

Ujjval Jauhari As global iron ore prices continue to move south, there seems no respite for NMDC, India’s largest producer of the ore. The company once again had to resort to price cuts, fixing prices for lumps at Rs 2,100 per wet metric tonne (WMT) and fines at Rs 1,560 WMT effective November 26. These selling prices are almost half the levels of Rs 4,200 per WMT for lumps and Rs 3,060 per WMT for fines seen in January 2015. Thus, it’s not surprising that the company’s market cap is 62 per cent of what it was at start of the year.

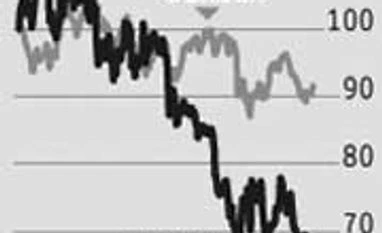

The declining Chinese steel demand is hurting the prospects of all steel, as well as raw material producers globally and in India. The 62 per cent Fe grade iron ore prices (China) that were close to $70 a tonne a year ago are now $44 a tonne. Chinese demand has shrunk six per cent during January-October and production cuts are slower than the contraction in demand, leading to huge over-supply and pressure on steel prices, say analysts at Kotak Securities. The slowdown in the steel industry is hurting raw material prices, with structural over-supply in iron ore from large miners, they add.

In the domestic arena, steel consumption has grown only 4.5 per cent year-to-date. During the period, while imports have grown 42 per cent, steel production has declined 0.4 per cent. With supplies of iron ore easing in the country, the pressure on iron ore demand and realisations for NMDC is understandable. The company had seen its earnings before interest, taxes, depreciation and amortisation (Ebitda) decline 55 per cent during the September quarter, with offtake declining 11 per cent and realisations plummeting 42 per cent over the year-ago period.

While NMDC is doing its bit by boosting production at its Chhattisgarh and Karnataka mines and plans to achieve 38 million tonnes (mt) volumes during the current financial year, an increase of 26 per cent, the same now looks ambitious. The shipments in the first half are down by 18 per cent year-on-year and account for only one-third of the guidance.

Not surprisingly, analysts have cut their earnings estimates for NMDC and lowered their target prices for the stock. However, at Rs 92.75, the stock is not far from its nine and a half year lows of Rs 90 in August this year, and might have bottomed out unless ore prices fall further.

The consensus target price, according to analysts polled on Bloomberg in the month of November, stands at Rs 93, also indicates the stock is fairly valued. Analysts at IIFL who have a target price of Rs 97 for the stock say the downside for the stock would be supported due to the company’s good dividend yield. The company’s huge cash and bank balances of Rs 20,000 crore also provide cushion.

)

)