Prices of steel products continue to slide in March

Chinese inventories, cheaper imports cap domestic prices

Malini Bhupta Mumbai As 2014-15 draws to a close, the earnings outlook for steel companies in the quarter ending March appears dim. With demand for steel products weakening further during the quarter, producers are cutting output and prices, as inventories increase in China.

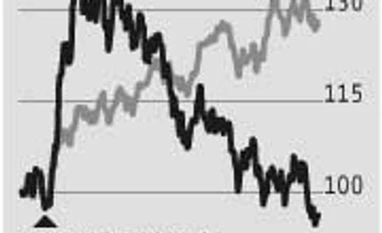

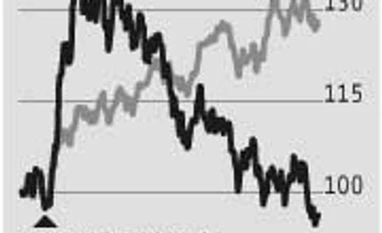

During the week ended March 13, prices of steel products continued to decline. Long product prices fell 3.1 per cent week-on-week at Rs 31,400 a tonne, while sponge iron prices fell five per cent to Rs 18,050 a tonne, shedding all gains in the past few weeks. Scrap prices are down 3.5 per cent at Rs 22,300 a tonne. Largely, the fall in prices was due to higher supplies from China, say analysts.

Steel producers claim cheaper imports into India have continued to surge through 2014-15. Goutam Chakraborty of Emkay Global says latest data show steel imports into India surged 147 per cent between April and December 2014, compared to the year-ago period. In January, imports rose 127 per cent. Total steel imports into India stand at 8.1 million tonnes (mt), of which Chinese imports account for 2.9 mt. Indian steel production continued to be weak this year, growing 0.3 per cent year-on-year at 7.07 mt in January. Steel output has slowed compared to December, when production grew 2.4 per cent annually.

The weak global prices have capped domestic steel prices, though some depreciation in the rupee helped. Global steel prices have continued to fall at an accelerated pace, as demand continues to weaken across various regions (excluding Europe). While the sharp fall in the Commonwealth of Independent States free on board export price to $390 a tonne has been a worry, Chakraborty does not expect further downside.

But that doesn’t mean steel prices are likely to recover, as a lot depends on China. Chinese inventories have continued to rise through the past few months, though exports eased in February. Crude steel production across the globe has remained weak. According to Motilal Oswal Securities, crude steel production in the US fell 1.3 per cent in January to 10 mt, while global crude steel production contracted 2.9 per cent in January to 133 mt, the first decline in global steel production since August 2012. Steel producers have already reported lower output in February. March might not be very different.

)

)