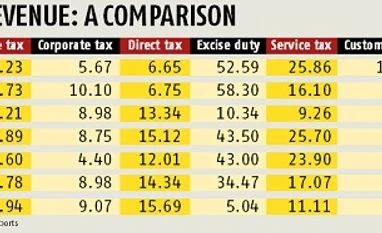

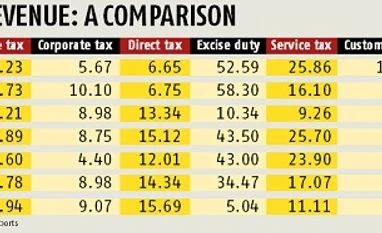

Let us start with income tax (IT). The budgeted estimation of IT for FY 2016-17 was 20.21 per cent, whereas it was 24.60 per cent in the first three quarters of FY 2016-17. Moreover, the growth in income tax revenue in the first three quarters of FY 2015-16 was only 1.73 per cent, against 8.23 per cent for FY 2015-16, which means that growth in IT revenue picked up only in the last quarter of the financial year than the first three quarters. However, with demonetisation, there was a sudden surge in income tax payments in November and December 2016, as those who have undisclosed income so far decided to pay advance IT to justify their demonetised cash deposits in the banks. The revised estimate for FY 2016-17 shows the same trend of about 25 per cent growth in IT revenue.

Then comes corporate tax. Growth in corporate tax has been customarily high during the first three quarters than the last quarter. However, the decline in corporate tax revenue growth from 8.75 per cent in the first eight months to 4.40 per cent in the first nine months of FY 2016-17 indicated that payment of corporate tax virtually stopped after demonetisation till December 2016. However, with the economy reaching near-normal in January 2017, it is no surprise that the FM expects 8.98 per cent increase in corporate tax revenues for FY 2016-17 and 9.07 per cent for FY 2017-18.

Excise duty (ED) revenue growth was 52.59 per cent in FY 2015-16 and expected to be 34.47 per cent thanks to passing the benefit of reduced crude oil prices to the ED kitty. About 70 per cent of ED comes from various forms of crude oil products. The marginal slowdown of micro, small and medium enterprises in November and December 2016 after demonetisation has not impacted the growth of ED revenue in the first three quarters of 2016-17 and FY 2016-17 also. As there is no scope for any further fall in crude oil prices, growth in ED for FY 2017-18 was set at 5.04 per cent only.

Service tax (ST) constitutes about 28 per cent of the indirect tax revenue and about 14 per cent of the total tax revenue. The ST revenue for April-December 2016 also witnessed a growth rate of 23.90 per cent against the budgeted growth of 10 per cent. Why such a huge growth despite demonetisation? It is an irony that people spent a lot in November 2016 on services such as large-scale booking of 1 AC and 2 AC tickets, air tickets and resorts to flush out as much as unaccounted demonetised currency as possible and the resultant bumper ST collections in November and December 2016. Considering the normalcy in ST collections after January 2017, the finance ministry revised ST revenue growth at 17.07 per cent for FY2016-17 and moderately fixed ST growth at 11.11 per cent for FY2017-18.

From the above analysis, there is no statistical reasoning to suspect that tax revenue growth data released by the finance minister for FY 2016-17 was cooked up. In fact, being conservative in estimating tax revenue growth becomes the signature item of the Arun Jaitley.

The author is an IIMA doctorate teaching at TAPMI Manipal. Views are personal

)

)