Recovery hopes dashed for current financial year

Economists have begun downgrading their GDP estimates for the current fiscal as constraints to growth persist

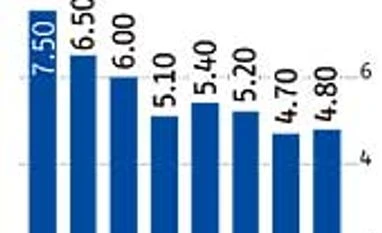

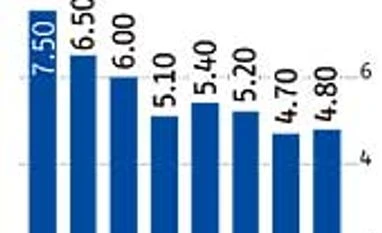

Malini Bhupta Mumbai India's economic growth has plummeted to a 10-year low of five per cent in FY13 and the new fiscal is unlikely to be any better as the economy will continue to be constrained by the usual suspects.

The fourth quarter data (GDP at factor cost grew 4.8 per cent) makes it clear the second half has not seen any green shoots. Agriculture, industry and services have continued to decline through the year, more so during the fourth quarter. Despite expectations of a good rabi crop, agriculture has grown at 1.4 per cent in Q4, just as manufacturing continued to languish at 2.6 per cent, compared to last year. Utilities (power, gas and water) grew at an anaemic 2.8 per cent.

Economists believe the economy continues to be constrained by the usual suspects, like infrastructure bottlenecks, slower external demand, high capital costs and supply side issues. Richard Iley, chief economist for India at BNP Paribas, believes the weak growth in utilities is possibly "reflecting the infrastructure bottlenecks that continue to undermine the supply side". Going by the political environment, these bottlenecks are likely to afflict growth in FY14, too.

The savage spending cuts by the finance minister have also come to haunt the economy. Government consumption spending slipped to below one per cent during the quarter, which pushed down growth in the community, social and personal services. Economists are calling this the Great Chidambaram Squeeze. Abheek Barua, chief economist at HDFC Bank, says: "With the government pulling back, it is imperative that the private sector pick up the slack and support growth. Signs of that happening are so far not visible." During the quarter, private consumption is down to 3.8 per cent from 4.2 per cent a quarter ago. Similarly, gross fixed capital formation has also slowed to 3.4 per cent from 4.5 per cent a quarter ago.

Going forward, a possible rate cut by the central bank could support growth and investments. Some revival in external demand (exports) could also come to support growth, but this may not be much compared to the extent of the slowdown. Going by the outlook, Deutsche Bank has revised its FY14 estimates by 50 basis points to six per cent.

)

)