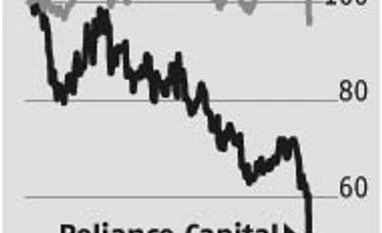

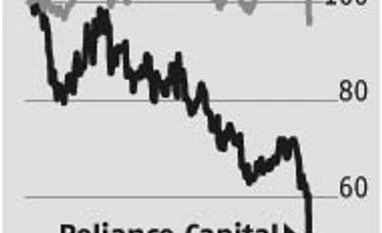

Reliance Capital: The under-performance seems unjustified

Monetisation of stake in insurance firms, fund-raising key catalysts

Sheetal Agarwal The Reliance Capital stock underperformed the S&P BSE Sensex and many of its peers over the past year. It has fallen sharply in the past few days to a 42-month low on an intra-day basis following the mayhem in markets this week.

Slowdown in life insurance business, consolidation in lending business, and delay in tying up with a bancassurance partner are some reasons for the under-performance.

ALSO READ: RCap finishes sale of multiplex business In the medium term, the life insurance business is likely to be under pressure. But it is more to do with the company re-aligning its distribution away from third-party distributors to owned work-force. The company is awaiting regulatory nod enabling banks to partner multiple insurance players for distribution.

While inexpensive valuations seem to adequately factor in concerns, some of its businesses, consumer lending, asset management and general insurance show healthy prospects. Reliance Capital’s lending business has seen 13 per cent growth in the June 2015 quarter after under going consolidation in two years. Save for one-offs, asset quality trends remain stable and the company’s focus on lending to secured segments such as mortgages is a positive. The asset management and general insurance businesses have been posting steady show in the past few quarters and the trend is likely to continue.

There are a host of triggers for the stock, including the stake sale in its general and life insurance businesses to existing/new partners after the increase in foreign holding limit in the sector. “Stake sale and monetisation will not only boost return on equity, but also help de-leverage Reliance Capital’s balance sheet,” says Kunal Shah, financials analyst, Edelweiss Securities, who has a ‘buy’ rating with a target price of Rs 638 on the stock.

Among other initiatives, the hiving off of loss-making segments in its broking and distribution businesses should lead to better profitability. Given this backdrop, the stock’s under-performance seems unjustified.

Most analysts polled by Bloomberg remain positive on Reliance Capital. Their average target price stands at Rs 586, against the current price of Rs 280. The risk is most of the company’s businesses are linked to capital markets. Hence, any adverse movement in the same for a prolonged period can hit profits. Competition and strategies’ execution are key monitorables.

)

)