SAIL revival hinges on cost tightening

While operating performance could improve, it may not be enough to help SAIL turn profitable

)

Explore Business Standard

While operating performance could improve, it may not be enough to help SAIL turn profitable

)

Steel manufacturers have seen a sharp reversal in fortunes after the government implemented a minimum import price (MIP) for many products last February. This gave a respite from cheaper imports, boosting realisations and demand for companies.

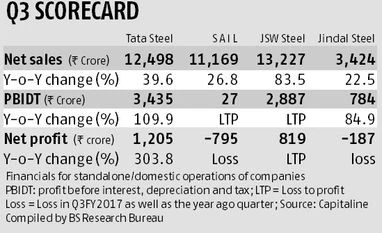

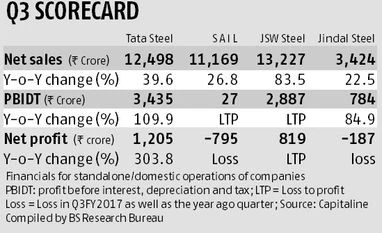

Steel Authority of India (SAIL), too, benefited and showed considerable improv-ement in profitability till the September quarter but could not sustain it in the December quarter. More dependent on domestic sales, it was impacted by the note ban as its volumes were hurt, while rising coal costs also took a toll. While analysts expect its operating performance to improve, they doubt whether it will be enough to enable the government-owned company to turn profitable.

Volume sales at 3.3 million tonnes were up 13.8 per cent year-on-year but 8.3 per cent lower than the 3.6 mt the previous quarter. Tata Steel saw volumes growing in the domestic business due to expansion at its Kalinganagar plant. JSW Steel compensated for decline in the India business with exports, and restricted the overall sales volume decline to five per sequentially. Even Jindal Steel & Power, much smaller than SAIL, saw volumes rise 3.7 per cent sequentially, helped by exports; its profit got a boost from its focus on value-added products.

For SAIL, the decline in volumes was accompanied by increasing realisation, also true for peers. At Rs 34,237 a tonne, it increased nine per cent sequentially and 11 per cent year-on-year for SAIL. But, rising costs more than offset the pricing gains. Coal costs alone were up Rs 5,000 a tonne sequentially, leading to an Ebitda (earnings before interest, taxes, depreciation and amortisation) loss of Rs 43 crore, from a profit in the previous two quarters, despite net sales growing 26.4 per cent from a year before in the December quarter. Sales were up marginally on a sequential basis.

This is in sharp contrast to peers. Tata Steel reported Ebitda per tonne of Rs 11,285 in the domestic/standalone business; for JSW Steel, Rs 7,717, up nine per cent sequentially. JSPL also saw steel segment earnings before interest and tax improve to Rs 870 a tonne.

Rising coal costs remain a concern, as full effects will be seen in the March quarter, say analysts. International coal prices, after rising from $80 a tonne a year before to a little more than $300 a tonne in November, have corrected to about $170 a tonne. If it stays at these levels, it will be a breather for all, particularly SAIL.

Rising realisations also bode well. SAIL also raised prices at the start of January. Analysts at Elara Capital say they expect SAIL to turn profitable at Ebitda level due to these, which will more than offset the rise in coking coal cost.

While operating profitability might rebound for SAIL, the challenge is whether it will be enough to take care of interest costs and rising depreciation expense as the company commissions new capacities. Depreciation costs rose 26.3 per cent over a year to Rs 670 crore in the December quarter and interest costs to Rs 611 crore. As a result, the company reported a net loss of Rs 795 crore in the quarter. Although lower than the loss of Rs 1,481 crore in the year-ago period, this was Rs 568 crore in the September quarter. More, news reports suggest that the government will be slowly withdrawing MIP on the remaining products.

Analysts at Motilal Oswal Securities expect Ebitda per tonne to improve to Rs 40 and Rs 3,290 in FY18 and FY19, respectively, as against expectations of an Ebitda loss of Rs 177 in FY17, helped by improving volumes and higher steel prices. However, the burden of interest and depreciation would mean losses, they add. Thus, SAIL needs top do more to turn profitable at the net level, too.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Feb 16 2017 | 3:12 AM IST